Residential Real Estate News

Homes Change Hands Every 12 Years in America

Residential News » Seattle Edition | By David Barley | March 2, 2023 8:48 AM ET

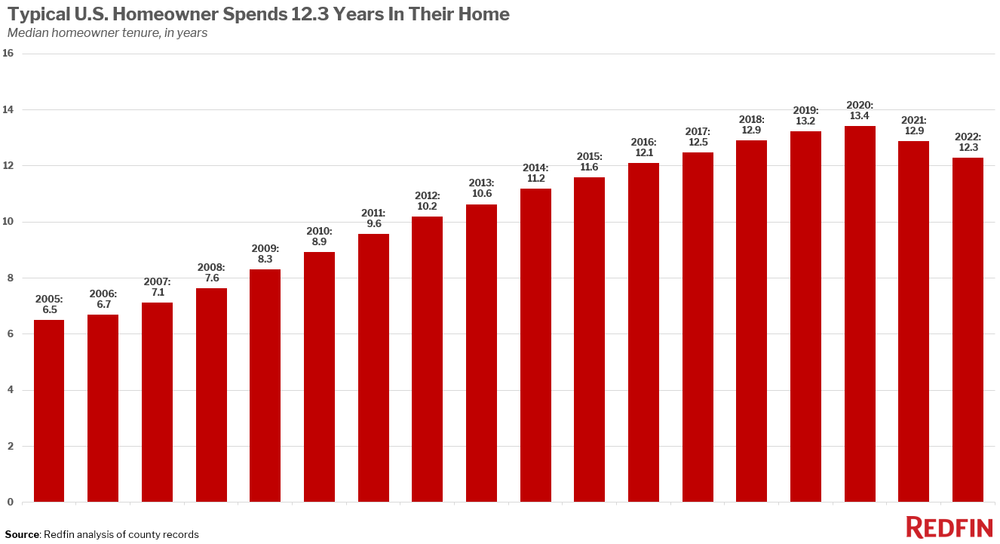

Down From 2020 Peak of 13.4 Years of Ownership Tenure

National property broker Redfin is reporting this week the typical U.S. homeowner spends 12.3 years in their homes now. That's down from the peak of 13.4 years hit in 2020 and 12.9 years in 2021.

But the typical American is still living in their home much longer than before, with median homeowner tenure sitting at about 10 years in 2012 and 6.5 years in 2005.

Older people aging in place are driving the general trend toward longer homeowner tenure. Most Americans 65 and older have owned their home for at least 23 years, and most Americans aged 35 to 64 have owned theirs for at least eight years. Compare that with homeowners under 35: Nearly half (49%) have owned their home for three years or less, and another 37% have owned theirs for four to seven years.

Overall homeowner tenure has ticked down from its peak largely because so many people moved from one home to another in 2021 and the first half of 2022. Record-low mortgage rates during that period motivated many Americans to buy homes, either becoming homeowners for the first time or selling their home to move to a better one. Pandemic-fueled remote work prompted many Americans to relocate to a different part of the country, too.

But Americans are staying put much longer now than in the past couple decades. There are several reasons why that's true, and why homeowner tenure is likely to stay elevated in the coming decade:

- Older Americans are aging in place. Long homeowner tenure is driven by older generations and the population is aging. Roughly 17% of people in the U.S. are 65 or older, up from about 13% in 2010, and the share is expected to continue increasing.

- Lack of affordability. Typical monthly mortgage payments are near their record high, discouraging many people from moving.

- Lack of move-up buyers. Roughly 85% of mortgage holders have an interest rate far below 6%, disincentivizing them from giving up their comparatively low rate and moving.

- Historically high rental prices. Asking rents are still higher than they were before the pandemic. That's motivating some homeowners to become landlords rather than sell.

- Shortage of homes for sale. The supply of homes for sale is near historic lows and very few new listings are coming on the market. Even if a homeowner were considering a move, there's not much to choose from.

"Even though the length of time Americans are staying in their homes has ticked down from the peak it reached in 2020, it's likely to head back up again in the next few years," said Redfin Senior Economist Sheharyar Bokhari. "Today's mortgage rates are more than double the lows reached during the pandemic homebuying frenzy, which means people have extra incentive to hang onto their homes. Even if rates dip down to 4% or 5%, that's still significantly higher than the sub-3% rates many homeowners have now. That lock-in effect, combined with older Americans' desire to stay put in their homes, points to lengthening tenure in the future."

"But although that limits the number of homes hitting the market, competing forces could help the supply shortage," Bokhari continued. "Remote work is still much more popular than before the pandemic, so more people have the freedom to relocate or move further away from city centers. Plus, millennials--the largest generation in the U.S.--are in prime moving years, pushed to sell their homes by things like growing families and new jobs."

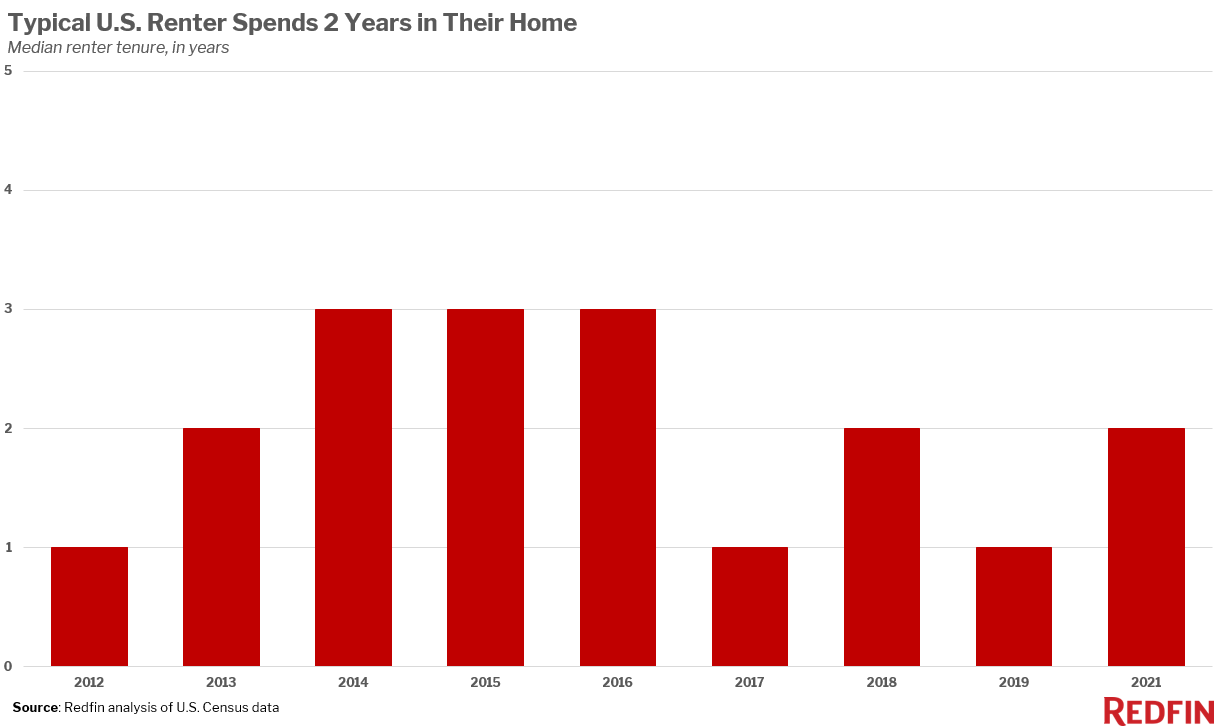

Renters move much more often than homeowners, which creates a mismatch between the number of homes for sale and the people who want to buy one

The scarcity of homes for sale is contributing to double-digit homeowner tenure, and the reverse is also true: Long tenure is holding back supply.

That's problematic for people who want to buy a home but are unable to find one they can afford. The fact that renters move much more often illustrates the issue. The typical renter stayed in their home for two years in 2021, versus 13 years for homeowners. Most renters have to move to another rental rather than buy a home because of the mismatch between the number of people moving and the number of homeowners listing their home during any given year.

That's especially true for younger Americans because they move more often. Nearly three-quarters (72%) of renters under 35 years old spend three years or less in a rental property, compared with 39% of 35-64 year olds and 27% of people aged 65 and older.

Overall, the typical length of time renters stay in any one rental home hasn't fluctuated much over the last decade. The median has bounced between one, two and three years for the last decade.

Californians keep their homes longest; homeowners in Louisville and Las Vegas hold on less than half as long before moving

Homeowners stay put longest in expensive parts of California. The typical Los Angeles homeowner has owned their home for 18.2 years, followed by 17.3 years in San Jose. Cleveland (17.1 years), San Francisco (16.3 years) and Memphis (16.2 years) round out the top five.

Tenure is shortest in relatively affordable migration destinations in the southern half of the country. It's shortest in Louisville, KY (6.9 years), followed by Las Vegas (7.6 years), Nashville (8.2 years), Raleigh (8.3 years) and Charlotte (8.3 years).

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026