Residential Real Estate News

Home Values in U.S. Reach New Peaks in June

Residential News » Seattle Edition | By David Barley | July 19, 2023 8:22 AM ET

Lack of inventory driving up prices as owners hang on to their homes

According to the latest Zillow Market Report, the typical U.S. home value eclipsed $350,000 for the first time ever as healthy demand from buyers continues to collide with reluctant sellers.

"Home buyers have persisted this spring despite daunting affordability challenges and record-low inventory," said Jeff Tucker, senior economist at Zillow. "Demand typically begins to ease in the summer, and there are signs that competition is waning, but large price declines are unlikely until more homeowners list their homes for sale."

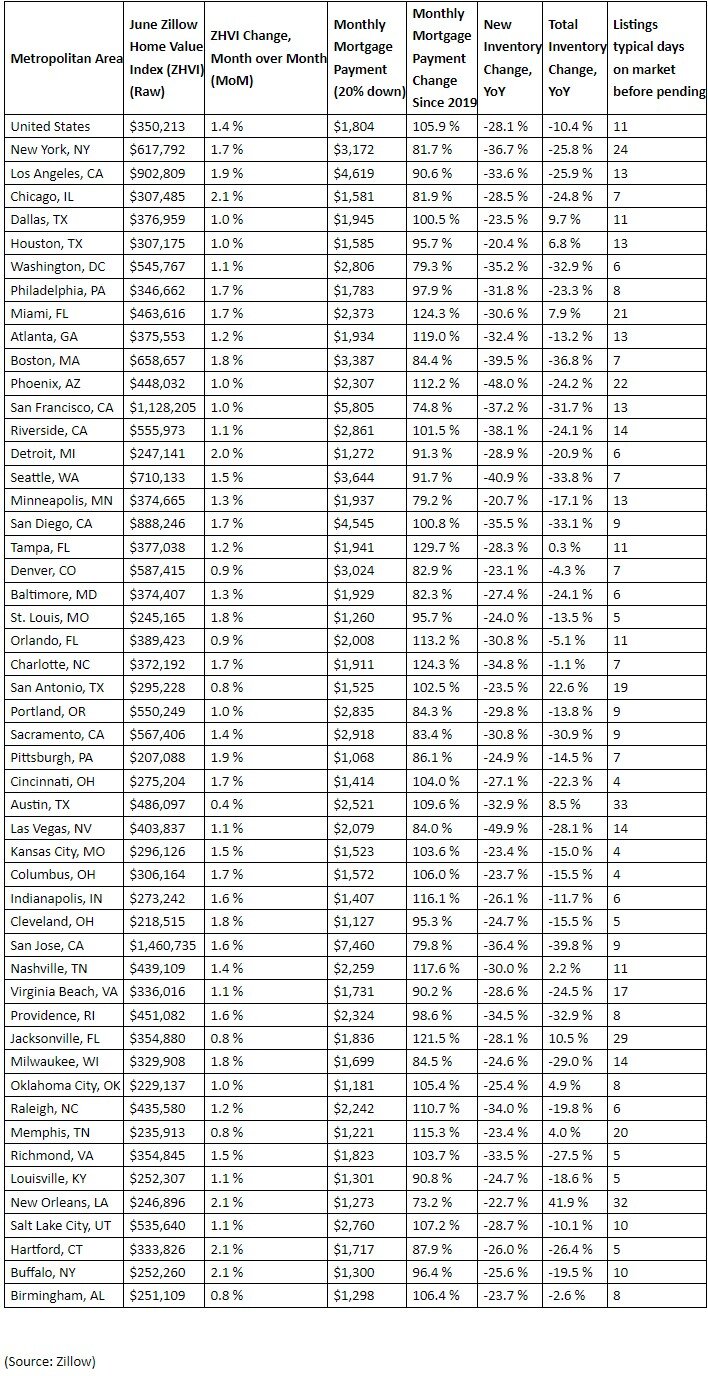

The typical U.S. home value climbed 1.4% from May to June, continuing a four-month hot streak. The new peak of $350,213 is almost 1% higher than last June and barely edges out the previous Zillow Home Value Index record set in July 2022.

From hot spots to soft spots: Local home value trends

Affordability remains the key to market strength, as lower-priced metro areas posted the largest monthly gains; Chicago, Buffalo, New Orleans, and Hartford all notched 2.1% monthly growth, with Detroit close behind at 2%. Those markets all have typical home values lower than the national average.

As in May, home values rose from the previous month in all 50 of the largest metro areas. The slowest monthly growth was in Austin (0.4%), followed by Jacksonville, Memphis, San Antonio, and Birmingham, which all saw 0.8% increases.

Drought of new listings intensifies

The flow of new homes for sale ticked up 2.4% month over month, but the annual deficit deepened, now standing at 28% fewer listings than a year ago. June is usually one of the best months for fresh inventory, but this year only 376,500 new listings arrived on the market. That's closer to levels seen in the slower months of February and October than to average new listings in June (505,100), according to Zillow data reaching back to 2018.

A lack of new listings has dogged the housing market for nearly a year, and higher mortgage rates remain the chief suspect. Rates at 6.8% this week (the highest since November, up from 5.1% a year ago and 3% two years ago) make it especially costly for homeowners -- most of whom have a mortgage well below today's rates -- to borrow for their next home purchase.

Another explanation could be that homeowners are holding out for higher prices. Home values have steadily increased since January in much of the country but remain below peaks reached last summer in many markets.

"It could be that some homeowners have been waiting until prices set new highs in their market before opting to cash in their chips," Tucker said.

The total pool of existing homes for sale is lower than any June since at least 2018. It's down 10% from last year and a tremendous 45% below June 2019.

Drop-off in demand means less competition for buyers

Potential buyers could see some slight relief on the horizon, as a few metrics indicate demand and competition are cooling. Sales measured by newly pending listings dipped almost 5% from May to June, following seasonal trends seen in 2022 and before the pandemic, when accepted offers crested in May.

Listings also lasted longer in June, 11 days before the typical listing went pending, compared to 10 in May. But that's still a much faster market than in 2019, when listings went pending in 21 days.

Rent growth is back to normal

Zillow's latest monthly rent report shows rent growth is back to pre-pandemic norms for this time of year, about 0.6% per month. San Diego overtook San Francisco as the third-most-expensive place to rent.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026