The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

UK Office and Retail Sectors: A Tale of Two Markets

Commercial News » London Edition | By Michael Gerrity | June 19, 2015 9:04 AM ET

According to international real estate consultancy Knight Frank, the recovery for UK's commercial property is again turning multi-speed, with office and retail sectors living in different worlds.

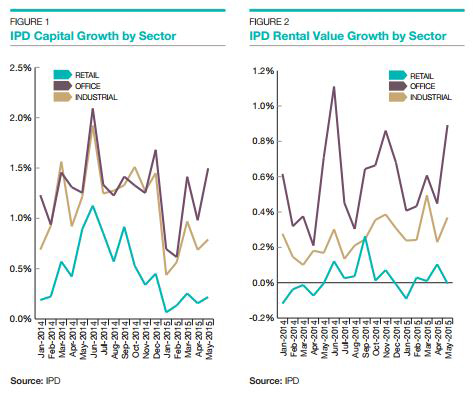

The winter and early spring were a time of deceleration for commercial property, following the heady capital growth seen in 2014. While in May IPD's capital growth index gained momentum, the improvement was not evenly spread across the sectors. As chart one shows, offices surged ahead, industrial achieved a less dramatic increase, and retail barely saw any improvement.

Why the disparity?

Industrial in recent years has enjoyed a fillip in the occupier and investment market from the rise e-commerce, but that is not 'news' any more. Possibly investors now view the internet effect as priced in, taking some of the heat out of the market.

This is perhaps a healthy downwards gear change, especially as the internet is no longer expanding its market share in retail as aggressively as a few years ago. In 2000 the office market became overheated in London and the South East, as property investors and developers overestimated the growth prospects of tech firms. Hopefully what we are seeing is a soft landing for industrial following its e-commerce boom of recent years.

This is perhaps a healthy downwards gear change, especially as the internet is no longer expanding its market share in retail as aggressively as a few years ago. In 2000 the office market became overheated in London and the South East, as property investors and developers overestimated the growth prospects of tech firms. Hopefully what we are seeing is a soft landing for industrial following its e-commerce boom of recent years.Explaining retail property's under performance is, however, getting harder. After all, the UK retail sales figures have been robust for some time, and the consumer has done much to support GDP growth by compensating for sluggish export demand and a retrenching government. Plus, there are the new occupier groups and shopping formats that have emerged to meet changing consumer trends, such as cafés, mini supermarkets, and click-and collect. These should be compensating for problems elsewhere in the sector.

Perhaps the explanation is to be found in leasing market fundamentals?

So far this year the UK shop vacancy rate has hovered around the 13% mark according to Local Data Company. This is in marked contrast to the steady decline in vacancy rates in many UK office markets, particularly in London and the South East where levels are in most cases lower than in 2007.

These dynamics are shaping rental growth, which is reasserting itself significantly in the office market, and barely in existence for retail. Admittedly, the rental growth for London and the South East is the driving force behind the IPD office figures, but there are signs this is spreading to the major regional city centres.

Consequently, rather than investors are missing a trick, it appears the weaker capital growth for retail is underpinned by leasing market fundamentals. Supply remains stuck at an elevated level, and probably dependent upon there being far less new development to bring stock in line with demand, unless some new occupier group appears that energizes the sector in the future.

In contrast, the rate of rental growth now being experienced by offices deserves special mention. Rental growth for IPD offices peaked at 8.6% (on a 12 month basis) in August 2007. Today the figure stands at 7.8% and rising, and London will power the IPD offices figure through that previous peak by the end of the year - in Victoria the vacancy rate is just 2.4%.

The development pipeline in London has been slow to respond to the pick-up in office demand, perhaps due to the general election, which is pushing up rents. In the financial sector in particular, occupiers are reviewing which business functions need to be in the capital, and other UK cities are starting to benefit. Investors may take the view that there are plenty of further opportunities to explore in the outperforming office sector before revisiting the more embattled parts of retail.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Investment in Asia Pacific Multifamily Properties to Double by 2030

- Multi-story Warehouses Are 15 Percent of Sydney's New Industrial Stock

- Manhattan Office Leasing Activity Lags in Q3 as Sentiment Remains Cautious

- Nonresidential Construction Spending Increases in America

- Office Conversions on Pace to Double in U.S.

- Hong Kong Office Vacancy Rates Stabilize After 4 Months of Increases

- Commercial Mortgage Debt Outstanding in U.S. Jumps to $4.60 Trillion in Mid 2023

- Architecture Billings Index in U.S. Remains Flat in July

- Commercial Mortgage Delinquencies Rise in America

- U.S. Data Center Demand Explodes in U.S., Driven by AI Growth in 2023

- Demand for Electric Vehicle Manufacturing Space Jumps Across the U.S.

- Global Cross Border Commercial Property Capital Flows Implode 52 Percent Annually in 2023

- 2023 Financing Constraints Rapidly Drive Down Construction Starts in U.S.

- New York City Named as U.S. Leader in Climate Change Resilience

- Tokyo is the City of Choice for Global Retailers in 2023

- Despite VC Cooldown, Life Sciences Represents 33 Percent of New Office Construction in 2023

- Despite Reduced Credit, U.S. Multifamily Developer Confidence Remained Positive in Q2

- Brisbane Office Market Enjoying Strong Leasing Activity in 2023

- Commercial Lending Dampened in 2023 by U.S. Market Uncertainty

- Asia Pacific's Commercial Investment Market Continues to be Challenged in 2023

- Despite Global Economic Uncertainty, Commercial Investment in Japan Grew in Q2

- U.S. Commercial Lending to Dive 38 Percent to $504 Billion in 2023

- Apartment Markets Across America Continue to Stabilize in 2023

- Cap Rates for Prime Multifamily Assets in U.S. Stabilize in Q2

- Ireland Office Market Making a Comeback in 2023

- U.S. Office Sales Total $15 Billion Halfway Through 2023

- AI and Streaming Drive Global Data Center Growth Despite Power Constraints

- Asia Pacific Logistics Users Plan to Expand Warehouse Portfolio in 2023

- Manhattan Retail Rents Continue to Rise in Q2

- Manhattan Office Leasing Activity Down 29 Percent Annually in Q2

- Commercial Property Investment in Australia Dives 50 Percent in 2023

- U.S. Architecture Billings Uptick in May

- Employees Return to Office Trend Growing in Asia Pacific Markets

- Exponential AI Growth to Drive Asia Pacific's Data Center Market

- Large Opportunity to Transform Australia's Office Market in Play

- Australian Industrial Rent Growth to Continue in 2023

- Corporate Relocations in U.S. at Highest Rate Since 2017

- North American Ports Volume Drops 20 Percent Annually in 2023

- Office Investment in Asia Pacific Remains Strong Despite Weaker Sentiment

- Australia's Build-to-Rent Properties Uptick on Lender's Wish List in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More