The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Top Commercial Investment Cities in the Americas Revealed, Los Angeles Tops List

Commercial News » Los Angeles Edition | By Michael Gerrity | March 11, 2016 10:00 AM ET

Multifamily is Most Attractive Property Type for Investment Ahead of Industrial

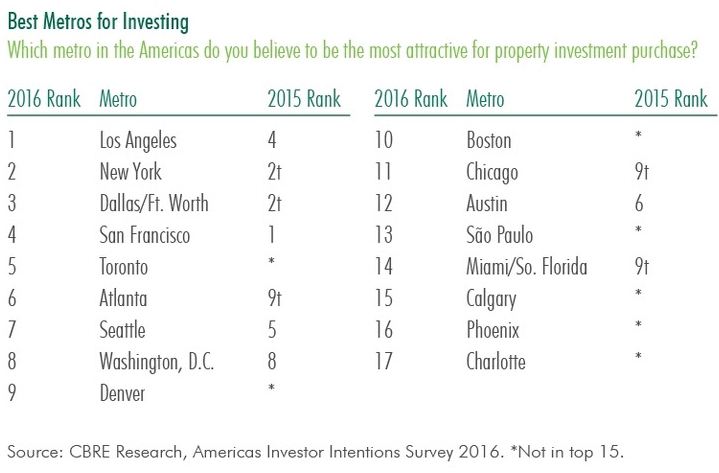

According to CBRE's newly released Americas Investor Intentions Survey 2016, the majority of real estate investors in the Americas intend to increase their property acquisitions in 2016, with Los Angeles as the top target market ahead of New York City and Dallas/Ft. Worth.

The 2016 survey results reveal that investment sentiment regarding commercial real estate purchasing activity remains positive, even in a more uncertain economic and capital markets environment. The survey reveals 65 percent of investors intend to be net buyers--up from 60 percent in 2015--with the vast majority (81%) intending to maintain or increase their purchasing activity in 2016.

Los Angeles ranked as the top metro for property investment this year, edging out New York City in second position. All other U.S. "gateway" markets ranked high among investors. The preferred "non-gateway" markets for investors include Dallas/Ft. Worth, Atlanta, Seattle and Denver. Toronto (5th) is the top ranking non-U.S. market.

"We expect investment in U.S. real estate will increase in the year ahead, driven by the relative strength and stability of the U.S. economy and good property fundamentals," said Brian McAuliffe, President, Institutional Properties, Capital Markets, CBRE.

"Multifamily, office and industrial will continue to be the products of preference; however we anticipate more capital will pivot in the year ahead towards retail than compared to 2015. Core and top-tier value-add will be best positioned to maintain high pricing and low yields, while second-tier assets and markets will feel some downward pricing pressure."

Among the five different investment types--core, secondary, value-add, opportunistic and distressed--value-add remains the preferred strategy (40%). The preference for value-add declined in the 2016 survey, while the preference for core (second highest) rose, indicating some reversion to a more conservative strategy. Similarly, investors' risk for secondary (non-core) assets edged down.

Multifamily (28%) is the most attractive property type to investors in 2016, replacing the industrial sector, which was last year's favorite. Office (24%) and industrial (23%) came in almost tied for second. Retail (17%) still lags behind the other sectors, but this percentage reflects a slight strengthening in preference from 2015.

Weak domestic economic performance (27%) is considered the number one threat to the property markets in the Americas in 2016--approximately the same as in the 2015 survey. Weakness in the global economy (25%), particularly as related to China, is perceived as the second largest threat to Americas' property markets in 2016.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Investment in Asia Pacific Multifamily Properties to Double by 2030

- Multi-story Warehouses Are 15 Percent of Sydney's New Industrial Stock

- Manhattan Office Leasing Activity Lags in Q3 as Sentiment Remains Cautious

- Nonresidential Construction Spending Increases in America

- Office Conversions on Pace to Double in U.S.

- Hong Kong Office Vacancy Rates Stabilize After 4 Months of Increases

- Commercial Mortgage Debt Outstanding in U.S. Jumps to $4.60 Trillion in Mid 2023

- Architecture Billings Index in U.S. Remains Flat in July

- Commercial Mortgage Delinquencies Rise in America

- U.S. Data Center Demand Explodes in U.S., Driven by AI Growth in 2023

- Demand for Electric Vehicle Manufacturing Space Jumps Across the U.S.

- Global Cross Border Commercial Property Capital Flows Implode 52 Percent Annually in 2023

- 2023 Financing Constraints Rapidly Drive Down Construction Starts in U.S.

- New York City Named as U.S. Leader in Climate Change Resilience

- Tokyo is the City of Choice for Global Retailers in 2023

- Despite VC Cooldown, Life Sciences Represents 33 Percent of New Office Construction in 2023

- Despite Reduced Credit, U.S. Multifamily Developer Confidence Remained Positive in Q2

- Brisbane Office Market Enjoying Strong Leasing Activity in 2023

- Commercial Lending Dampened in 2023 by U.S. Market Uncertainty

- Asia Pacific's Commercial Investment Market Continues to be Challenged in 2023

- Despite Global Economic Uncertainty, Commercial Investment in Japan Grew in Q2

- U.S. Commercial Lending to Dive 38 Percent to $504 Billion in 2023

- Apartment Markets Across America Continue to Stabilize in 2023

- Cap Rates for Prime Multifamily Assets in U.S. Stabilize in Q2

- Ireland Office Market Making a Comeback in 2023

- U.S. Office Sales Total $15 Billion Halfway Through 2023

- AI and Streaming Drive Global Data Center Growth Despite Power Constraints

- Asia Pacific Logistics Users Plan to Expand Warehouse Portfolio in 2023

- Manhattan Retail Rents Continue to Rise in Q2

- Manhattan Office Leasing Activity Down 29 Percent Annually in Q2

- Commercial Property Investment in Australia Dives 50 Percent in 2023

- U.S. Architecture Billings Uptick in May

- Employees Return to Office Trend Growing in Asia Pacific Markets

- Exponential AI Growth to Drive Asia Pacific's Data Center Market

- Large Opportunity to Transform Australia's Office Market in Play

- Australian Industrial Rent Growth to Continue in 2023

- Corporate Relocations in U.S. at Highest Rate Since 2017

- North American Ports Volume Drops 20 Percent Annually in 2023

- Office Investment in Asia Pacific Remains Strong Despite Weaker Sentiment

- Australia's Build-to-Rent Properties Uptick on Lender's Wish List in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More