The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Retail Property Lending in U.S. Surges in 2014

Commercial News » United States Edition | By Michael Gerrity | January 16, 2015 10:00 AM ET

According to CBRE, lending secured by retail properties surged through the first three quarters of 2014, up more than 50% from the same period a year ago.

Origination volume for retail loan closings saw a sizeable increase during Q2 and Q3 2014. Part of the increase reflects stronger refinancing activity, while it is also increasingly apparent that investors are looking for more opportunistic, higher-yielding opportunities in the sector.

Commercial real estate finance markets continued to improve during Q3 2014, with lending activity becoming increasingly broad-based across lenders, property types and strategies. While plentiful liquidity has contributed to these changes, the steady improvement in real estate fundamentals--which have spread well beyond the multifamily sector to the office, industrial and retail sectors--has contributed to increased risk-taking.

Commercial real estate finance markets continued to improve during Q3 2014, with lending activity becoming increasingly broad-based across lenders, property types and strategies. While plentiful liquidity has contributed to these changes, the steady improvement in real estate fundamentals--which have spread well beyond the multifamily sector to the office, industrial and retail sectors--has contributed to increased risk-taking.The year-to-date lending volume for the industrial and office sectors was up 31% and 20%, respectively. Multifamily lending also edged higher, although year-to-date volume was level with last year's figures. While capital continues to be attracted to multifamily housing, growth appears to have leveled off as prime acquisition opportunities have become highly competitive.

Banks improved upon their dominant market share of non-agency commercial lending during the Q3 2014; accounting for 40% of origination activity, up from 34% during Q2 2014. The recovery in the financial health of the banks has supported higher levels of competition and more flexible lending terms.

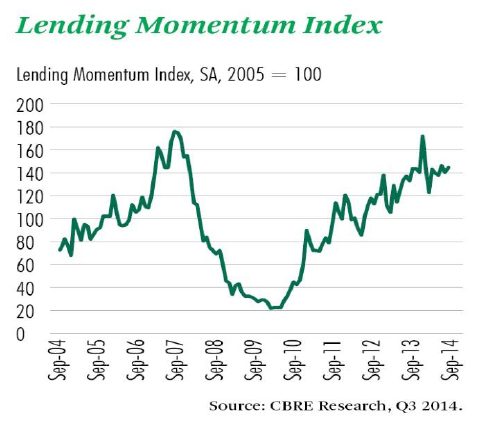

The CBRE Lending Momentum Index, which tracks the pace of U.S. commercial loan closings, increased 5.2% quarter-over-quarter and 8.9% above its year-earlier level. The index's rebound was driven by higher levels of property acquisitions and is indicative of a healthy commercial lending market with plentiful liquidity.

Brian Stoffers, Global President, Debt & Structured Finance of CBRE Capital Markets commented, "With more borrowers aggressively pursuing value-add deals, there is a clear sign that the risk spectrum has shifted outward in commercial real estate as investors continue to seek yield. The conditions that have supported increased liquidity for transactions remain favorable--U.S. Treasuries are falling, while the availability of both public and private real estate mortgage debt is increasing. As a result, borrowing costs for permanent, fixed-rate loans are declining and leading to increased property acquisitions."

"With more borrowers aggressively pursuing value-add deals, there is a clear sign that the risk spectrum has shifted outward in commercial real estate as investors continue to seek yield. The conditions that have supported increased liquidity for transactions remain favorable--U.S. Treasuries are falling, while the availability of both public and private real estate mortgage debt is increasing. As a result, borrowing costs for permanent, fixed-rate loans are declining and leading to increased property acquisitions."

Loan underwriting trends remained fairly stable and average debt service coverage ratios slightly decreased to 1.52x, compared to 1.53x in Q2 2014. Meanwhile, the percentage of loans carrying either partial or full interest-only payments over the loan term increased to 49% from 45% in Q2 2014; though still well below the 57% rated registered in Q1 2014.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Investment in Asia Pacific Multifamily Properties to Double by 2030

- Multi-story Warehouses Are 15 Percent of Sydney's New Industrial Stock

- Manhattan Office Leasing Activity Lags in Q3 as Sentiment Remains Cautious

- Nonresidential Construction Spending Increases in America

- Office Conversions on Pace to Double in U.S.

- Hong Kong Office Vacancy Rates Stabilize After 4 Months of Increases

- Commercial Mortgage Debt Outstanding in U.S. Jumps to $4.60 Trillion in Mid 2023

- Architecture Billings Index in U.S. Remains Flat in July

- Commercial Mortgage Delinquencies Rise in America

- U.S. Data Center Demand Explodes in U.S., Driven by AI Growth in 2023

- Demand for Electric Vehicle Manufacturing Space Jumps Across the U.S.

- Global Cross Border Commercial Property Capital Flows Implode 52 Percent Annually in 2023

- 2023 Financing Constraints Rapidly Drive Down Construction Starts in U.S.

- New York City Named as U.S. Leader in Climate Change Resilience

- Tokyo is the City of Choice for Global Retailers in 2023

- Despite VC Cooldown, Life Sciences Represents 33 Percent of New Office Construction in 2023

- Despite Reduced Credit, U.S. Multifamily Developer Confidence Remained Positive in Q2

- Brisbane Office Market Enjoying Strong Leasing Activity in 2023

- Commercial Lending Dampened in 2023 by U.S. Market Uncertainty

- Asia Pacific's Commercial Investment Market Continues to be Challenged in 2023

- Despite Global Economic Uncertainty, Commercial Investment in Japan Grew in Q2

- U.S. Commercial Lending to Dive 38 Percent to $504 Billion in 2023

- Apartment Markets Across America Continue to Stabilize in 2023

- Cap Rates for Prime Multifamily Assets in U.S. Stabilize in Q2

- Ireland Office Market Making a Comeback in 2023

- U.S. Office Sales Total $15 Billion Halfway Through 2023

- AI and Streaming Drive Global Data Center Growth Despite Power Constraints

- Asia Pacific Logistics Users Plan to Expand Warehouse Portfolio in 2023

- Manhattan Retail Rents Continue to Rise in Q2

- Manhattan Office Leasing Activity Down 29 Percent Annually in Q2

- Commercial Property Investment in Australia Dives 50 Percent in 2023

- U.S. Architecture Billings Uptick in May

- Employees Return to Office Trend Growing in Asia Pacific Markets

- Exponential AI Growth to Drive Asia Pacific's Data Center Market

- Large Opportunity to Transform Australia's Office Market in Play

- Australian Industrial Rent Growth to Continue in 2023

- Corporate Relocations in U.S. at Highest Rate Since 2017

- North American Ports Volume Drops 20 Percent Annually in 2023

- Office Investment in Asia Pacific Remains Strong Despite Weaker Sentiment

- Australia's Build-to-Rent Properties Uptick on Lender's Wish List in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More