Commercial Real Estate News

COVID Still a Drag on Hong Kong's Office Market

Commercial News » Hong Kong Edition | By Michael Gerrity | October 4, 2021 8:15 AM ET

Yet retail leasing momentum continued to improve in August

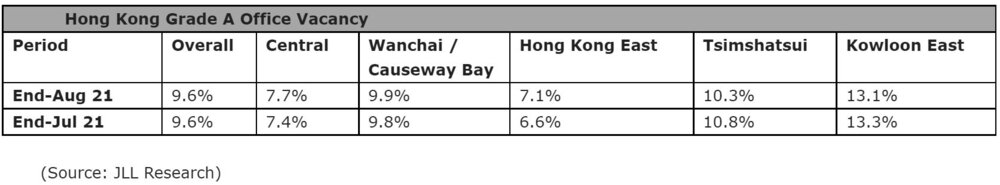

According to JLL's latest Hong Kong Property Market Monitor Report, net absorption in the overall office market continued to decrease to -10,900 sq. feet in August 2021. There were still some corporate downsizing activities due to the pandemic but those were largely offset by the upgrading demand and expansion of the flexible office space sector.

The flexible office sector expanded, following demand for flexible lease lengths and sizes, increasingly considered as essential real estate features by office tenants. For instance, Compass Offices expanded in-house at both Lee Garden One in Causeway Bay (16,200 sq. ft, LFA) and Infinitus Plaza in Sheung Wan (11,900 sq. ft, GFA), while Regus leased another floor (24,500 sq. ft, GFA) at The Gateway Tower 5 in Tsimshatsui.

The vacancy rate in Central rose to 7.7% as of end-August. Notwithstanding that some tenants opted to relocate to relatively more cost-effective locations, demand for premium office space in the submarket remained healthy. Notably, Chinese investment bank CICC reportedly took optionality expansion of up to 32,600 sq. ft (LFA) at One International Finance Centre as part of their renewal.

Alex Barnes, Head of Leasing Agency at JLL in Hong Kong said, "Despite a handful of buildings recording slight rental growth during the month, overall net effective rents dipped 0.1% m-o-m in August. Among the major office submarkets, Wanchai / Causeway Bay and Kowloon East experienced relatively larger rental decline, whereas rents in Central remained stable."

On the retail sector, Nelson Wong, Head of Research at JLL in Greater China, also noted, "Leasing momentum continued to improve in August. On the back of improvement in local consumption sentiment, retail sales saw an incremental growth of 7.6% y-o-y over the first seven months of the year. Domestic consumption is expected to be further stimulated by the consumption voucher scheme, driving retail sales growth in the coming months. Notably, a watch retailer has reportedly committed to a ground floor shop (1,500 sq. ft) at Imperial Building in Tsimshatsui for a monthly rent of HKD 700,000."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs