Commercial Real Estate News

Northeast U.S. Logistics Rents Skyrocket from E-commerce Explosion

Commercial News » New York City Edition | By Michael Gerrity | August 27, 2021 9:06 AM ET

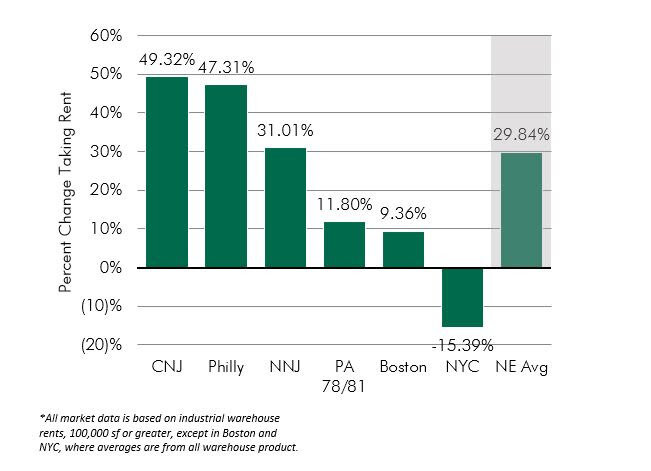

Global property consultant CBRE is reporting this week that the average industrial taking rents rose nearly 30% in the first half of 2021 compared to the first half of 2019 in the U.S. Northeast Corridor.

The Covid-19 Pandemic created a catalyst for companies shifting towards e-commerce strategies, culminating in significant demand for logistics space and a subsequent spike in higher taking rents. E-commerce and third-party logistics (3PL) users accounted for more than half of all industrial leasing activity in H1 2021. High demand is not the only driver behind increased taking rents; supply chain constraints, delayed construction timelines, and upended budgets resulted in low availability and contributed to bidding wars as occupiers compete for suitable space across the Northeast.

Vacancy within the Northeast Corridor dropped more than 70 basis points during the first six months of 2021, settling at a record low 3.3%. Nearly 50% of current construction was pre-leased as more retailers expanded their omnichannel strategies, often outsourcing to 3PLs to reduce delivery time to consumers and to keep up with demand.

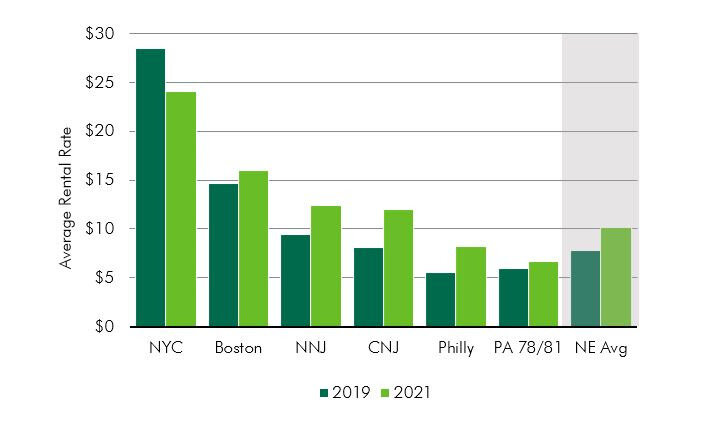

In H1 2019, overall average taking rents in the Northeast markets were $7.81 per-square- foot NNN, compared to $10.14 NNN in H1 2021. NYC saw a slight decrease in taking rents; during 2019, landlords traded moderate amounts of free rent for higher contract rents while current market fundamentals preclude these opportunities. The Central NJ and Philadelphia markets saw nearly a 50% rent growth from H1 2019 to H1 2021 as more companies targeted developable land south of Northern NJ where land is more available and rents are less expensive.

According to CBRE Research, nationally, average rent grew by 5%, year-over-year, in Q2 2021, as a comparison. The Northeast Corridor markets are among the top-performing industrial markets in the country. With e-commerce and 3PL occupier demand projected to remain high, availability is expected to remain low, and rents are likely to continue increasing through the rest of the year in the Northeast.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs