Commercial Real Estate News

Political Uncertainty, Gambling Crackdown Casts Shadow on Macau's Property Market

Commercial News » Macau Edition | By Michael Gerrity | February 24, 2022 9:01 AM ET

According to JLL in its Macau Year-end Property Review 2021, Macau's property market showed signs of recovery in mid-2021, however, the emergence of a new wave of epidemics at the end of the year suppressed the pace of recovery. The global economic and political uncertainties, coupled with the recent government crackdowns on illegal gambling and money laundering, are expected to cast a shadow over the outlook of the property market.

According to the DICJ statistics, Macau's gaming revenue recorded at MOP 86.86 billion in 2021, up 43.7% y-o-y. The gaming industry recovered in the first three quarters of 2021 but slowed down in 4Q21 due to the epidemic conditions and the issues with the VIP market. The revenue of the VIP market grew by 8.4% y-o-y to MOP 28.49 billion in 2021, accounting for 32.8% of the city's total gaming revenue, albeit contracting to 25.7% in Q421.

Macau's GDP totaled MOP 177.23 billion in the first three quarters of 2021, up 27.5% y-o-y. According to the statistics of the expenditure-based GDP, private consumption expenditure recorded growth of 9.0% y-o-y, and a trade surplus was recorded thanks to the recovery of the gaming industry in the middle of 2021. The fixed capital formation and government final consumption expenditure contracted by 0.4% and 0.3% respectively.

According to the DSEC statistics, Macau's total visitor arrivals totaled approx. 7,706,000 in 2021, up 30.7% y-o-y. With the lack of foreign visitor arrivals, visitors from Mainland China made up 91.4% of Macau's total visit arrivals, while the number of visitors visiting Macau under the Individual Traveller Scheme (ITS) accounted for about 34.8%. As of end 2021, the total supply of hotel rooms in Macau recorded at 37,700, up 10.6% from end 2020, as some of the hotels that were previously designated for medical observation are now no longer used as a quarantine facility. The cumulative occupancy rate of hotel rooms in Macau rebounded to 50.4%, while the average length of stay of guests maintained at about 1.7 nights.

Ongoing outflow of expatriate employees from Macau's labor market was observed in 2021. According to the DSEC statistics, the number of imported labor recorded at about 171,098 as of end December, a fall of 6,565 or about 3.7% from end 2020, mainly attributable to the decrease in imported labor in the domestic helper (-3,372), gaming (-2,557), and, hotel and catering (2,283) industries. However, the number of imported labor increased significantly in the construction sector. The overall unemployment rate recorded at 2.9% while the underemployment rate recorded at about 4.1%. The overall median monthly income rose to MOP 15,800. The total resident deposit in Macau recorded at MOP 667.65 billion as of end 2021, down 0.9% from end 2020.

"In 2021, the total property transaction value in Macau recorded at about MOP 49.77 billion, down 2.6% y-o-y. Both the total number and value of transactions reached a record low since the subprime mortgage-lending crisis. The repeated epidemics have delayed the pace of economic recovery for Macau and the issues related to junkets and "satellite casinos" will continue to occur in the year. The property market is likely to remain gloomy in the near term. Impacted by the current weak tourism and the crackdowns on illicit gaming operations, recently we have received lots of enquiries on valuation of hotel properties, mainly for investment and business strategy review and planning. Some institutional investors are considering selling the hotel assets in their portfolios to raise funds for investing in the higher quality projects in the peripheral areas. We expect hotels to become the focus among investors in 2022," says Mark Wong, Director of Valuation Advisory Services at JLL Macau.

Macau Office Market

In 2021, a total of 5,434 new incorporations registered in Macau, down 4.6% y-o-y. Impacted by the epidemics and the wave of early termination of lease by tenants, the office leasing market was under pressure and the overall office vacancy rate rose to about 12%. According to the JLL Macau Office Index, the rental values for the overall office market and Grade A office market fell by 4.6% and 1.0% y-o-y respectively. With the tight supply of Grade A offices, the impact on the leasing market was relatively mild. During the year, a total of about 35,000 sq. ft of office space was taken up by tenants for business expansion, with demand mainly coming from the insurance and finance sectors.

In the sales market, the number of office transactions fell by 6.4% y-o-y to a total of 146 in 2021, as shown by the DSEC statistics. The capital values for the overall office market and Grade A offices fell by 4.4% and 3.0% y-o-y respectively. The yields for the overall office market and Grade A office market recorded at 2.8% and 3.1% respectively.

A new office building was completed in Taipa at the end 2021, providing a total of 4,340 sqm of new office supply. The government is planning to retreat from the private office market by 2024, with the recent completion and operation of a number of government buildings. The office vacancy rate will continue to rise in the future, exerting pressure on office rentals. The recent issues with the VIP market in the gaming sector have led to a contraction in demand for office space by the sector's related tenants. We expect the office demand to remain at a relatively low level," says Matt Kou, Senior Manager, Leasing at JLL Macau.

2022 Office Market Forecast

Retail Market

According to the DSEC statistics, the total retail sales recorded at MOP 55.45 billion in the first three quarters of 2021, up 105.1% y-o-y. The proportion of tourist spending in total retail sales rebounded to 20.8%. Retail sales of most categories recorded growth except for Supermarkets that saw a fall of 8.3% y-o-y. Benefited by the strong demand for luxury goods from the visitors from Mainland China, as Macau has become one of their most popular outbound travel destinations during the epidemic, the retail sales of Watches, Clocks & Jeweler, Leather Goods and Communication Equipment saw the biggest growth, up 267.8%, 248.9% and 231.5% y-o-y respectively.

The retail property sales market recovered in 2021. A total of 392 retail property transactions were recorded, up 15.0% y-o-y. The majority of the transactions were from the retail units worth not more than MOP 50 million. According to the JLL Macau Retail Index, the capital values of top-tier retail properties fell by 16.0% y-o-y in 2021, while the retail rental value fell by 8.9% y-o-y. As of end 2021, the yield of top-tier retail properties recorded at about 1.9%.

"As the epidemic continues, the performance of retail submarkets varies. In the tourist areas, rentals of some retail properties have dropped by 70% from the pre-epidemic levels, due to the high vacancy rate. However, as tourists have generally adapted to the new way of travel, some retailers have taken up new space for expansion taking advantage of the significant fall in rentals. Some landlords provided relief to their tenants by offering rent concessions and various incentive packages. Some landlords who are relying on rental income for mortgage repayments have opted to leave their properties vacant when rentals have dropped to a very low level. It's because if the rental income of a property is too low, it may lead to a downward adjustment to the valuation of the property. The loan borrower or the property owner may face insolvency and be forced to sell his/her property," says Oliver Tong.

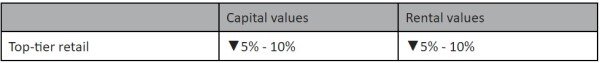

2022 Retail Market Forecast

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Commercial Property Investors Poised to Increase Allocations in 2026

- U.S. Commercial Mortgage Debt Climbs Toward $5 Trillion

- AI Sparks a Global $3 Trillion Data Center Supercycle

- AI Rewrites Playbook for Global Property Dealmakers, Says PwC

- Hong Kong's Central Office Market Enjoys First Rent Increase Since 2022

- U.S. Commercial Real Estate Lending Spikes in Q3

- Commercial Lending Surges in America

- North America Real Estate Enters a Tech-Driven, Boomers-Fueled Era in 2026

- U.S. Commercial Mortgage Delinquencies Ease in Q3

- Rents Hit 18-Year High in Tokyo as Japan's Office Market Defies Gravity

- Hong Kong Office Market Rebounds, IPO Activity Spurs Leasing Demand

- Poland's Commercial Markets Enjoy Rising Property Investment Activity

- Asia-Pacific Property Markets Show Signs of Revival as Investment Rises

- World Property Ventures Raising Capital to Digitize the Global Real Estate Economy

- U.S. Data Center Boom Tests Power Grid as AI Demand Outpaces Supply

- Commercial, Multifamily Mortgage Debt Climbs to Record $4.88 Trillion in U.S.

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs