Residential Real Estate News

Canadian Home Sales Recovery Continues in October

Residential News » Vancouver Edition | By Michael Gerrity | December 5, 2025 7:17 AM ET

Tightening Supply Lifts Market Momentum

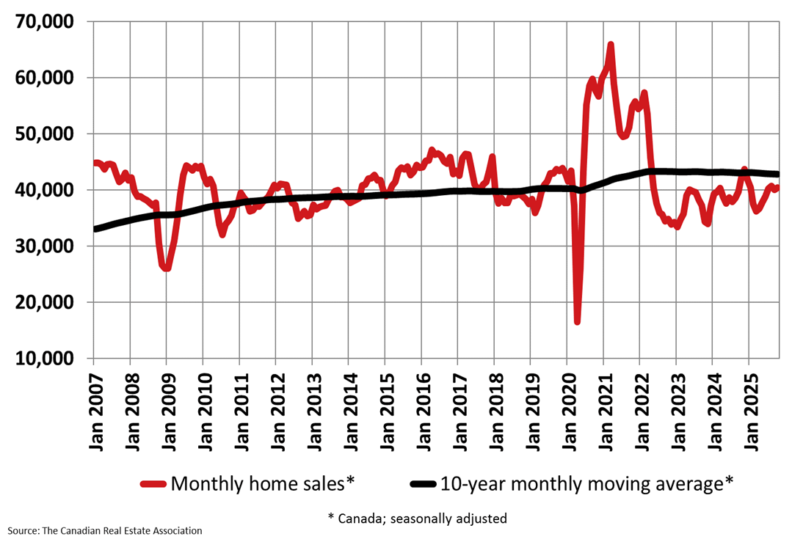

Canadian home resale activity notched another gain in October 2025, signaling steady -- if cautious -- renewal in demand across the country's housing markets. National MLS home sales rose 0.9% month-over-month, marking the sixth increase in seven months and underscoring a gradual rebound that began in the spring.

The pickup in transactions came as new listings slipped 1.4% from September, tightening overall market conditions. The national sales-to-new-listings ratio climbed to 52.2% from 51% a month earlier, inching closer to -- but still below -- the long-term average of 54.9%. Historically, ratios between 45% and 65% correspond to broadly balanced market conditions.

Total active listings reached 189,000 at the end of October, up 7.2% from a year earlier but broadly aligned with long-term seasonal norms. The number of months of inventory -- a key gauge of supply-demand balance -- held steady at 4.4 months for the fourth consecutive month, matching the lowest level since January. That remains slightly below the long-term average of five months. Market conditions typically tilt toward sellers when inventory falls below 3.6 months and toward buyers when it exceeds 6.4 months.

"After a brief pause in September, home sales across Canada picked back up again in October, rejoining the trend in place since April," said Shaun Cathcart, senior economist at the Canadian Real Estate Association. "With interest rates now almost in stimulative territory, housing markets are expected to continue to become more active heading into 2026, although this is likely to be tempered by ongoing economic uncertainty."

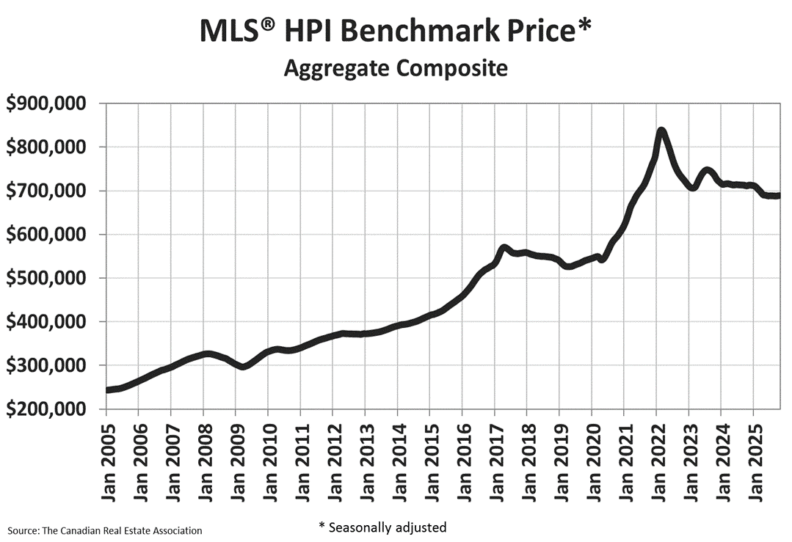

On the pricing front, the National Composite MLS Home Price Index edged up 0.2% between September and October. On a non-seasonally adjusted basis, the benchmark index fell 3% year-over-year -- its smallest annual drop since March -- indicating that price declines may be nearing a floor. The national average sale price stood at $690,195, down 1.1% from October 2024.

Taken together, the latest data suggests Canada's housing market is slowly stabilizing as borrowing costs ease and buyers tentatively re-enter the market -- though the path toward a sustained recovery remains bound to the broader economic outlook as 2026 approaches.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026