Residential Real Estate News

Why Pre-Biden Mortgages Froze the U.S. Housing Market

Residential News » Irvine Edition | By Michael Gerrity | December 24, 2025 7:10 AM ET

The U.S. housing market isn't breaking. It isn't rebounding. It's frozen -- held in place over the last 3 years by the quiet force of lower mortgage rates, specifically those that originated before the Biden presidential era.

Tens of millions of homeowners remain locked into loans carrying interest rates below 4%, a remnant of the pandemic refinancing boom. Replacing those mortgages today would mean rates above 6% and double-digit jumps in monthly payments. For most households, the math doesn't work. They stay put.

Repeated across the country, that decision has reshaped the housing market into one that is slower, tighter, and unusually resistant to price correction.

Mortgage Lock-In Freezes Supply

Low-rate mortgages have become financial handcuffs. They offer stability, predictable payments, and a rising equity cushion--but discourage movement. The result is a market where homeowners are comfortable, yet immobile.

"The 30-year fixed mortgage makes the U.S. housing market fundamentally different," said Thom Malone, principal economist at Cotality. "It creates stability, but it also anchors homeowners in place. When demand weakens, prices don't necessarily adjust. Sellers wait. The cycle becomes about transaction volume, not price discovery."

The structure is uniquely American. Thirty-year fixed loans shield borrowers from interest-rate volatility and lock in payments for decades. That protection also slows the market's ability to reset when conditions change.

Why Other Markets Reprice Faster

Outside the U.S., housing markets respond more quickly to rate shifts. In Canada, the UK, New Zealand, and Australia, mortgages typically reset every few years or float with market rates. When borrowing costs rise, monthly payments follow, forcing households to respond.

That feedback loop accelerates adjustment. Higher payments pressure budgets, sellers cut prices, and transactions resume at lower clearing levels.

The U.S. system moves differently. Sellers can afford to wait, and that patience creates bottlenecks that ripple across the market. Fewer listings mean fewer sales, even when demand exists.

Affordability Gap Widens

Affordability has deteriorated sharply. Over the past five years, U.S. per-capita income rose about 25% in nominal terms. Home prices climbed 55%. Inflation erased much of the income gain, while mortgage rates doubled from roughly 3% to above 6%.

Ownership costs have risen on multiple fronts. Property taxes increased in many counties. Insurance premiums surged, particularly in wildfire- and hurricane-exposed regions. For many households, the cost of owning has begun to outpace wage growth--even without moving.

Most owners remain insulated by equity and low fixed rates, allowing them to absorb higher costs without being forced to sell.

Movement Driven by Life Events

Cotality economists say the pressure resembles the slow buildup seen before the Great Recession--not through leverage, but through rigidity. Stress points arrive incrementally: an insurance renewal, a tax reassessment, a new mortgage quote.

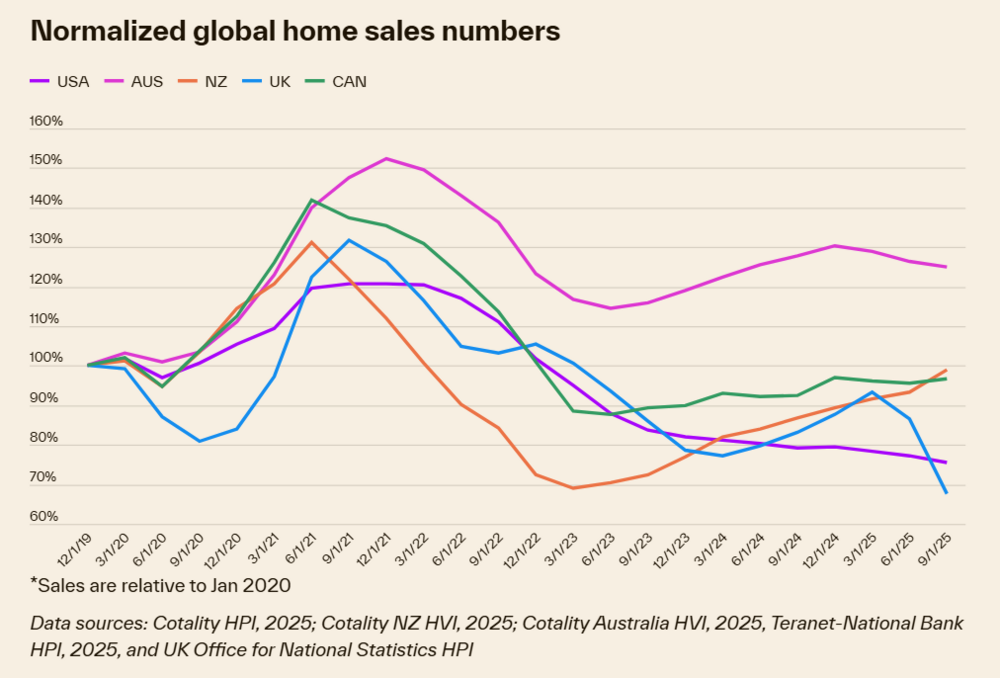

For now, households are choosing safety over flexibility. Sales volumes have fallen to roughly 75% of their 2020 levels, while inventory remains thin. Owners feel constrained by rates they cannot replace.

Movement happens when life intervenes--marriage, divorce, new jobs, longer commutes, or retirement plans. Those events don't wait for rate cuts or market clarity. Over time, they accumulate.

Global Markets Offer Contrast

Countries with faster mortgage resets show how adjustment unfolds when rate changes flow directly into household budgets.

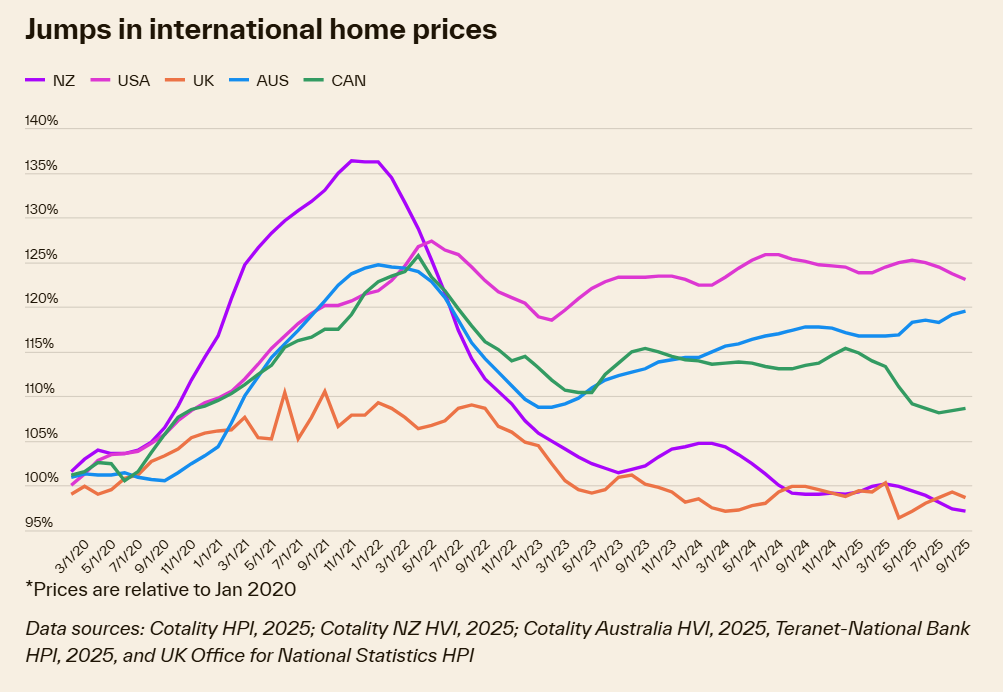

From peak levels, home prices fell about 10% in the UK, 14% in Canada, and 28% in New Zealand. Australia avoided a nominal decline, but inflation absorbed most of the gains, leaving real prices about 4% below their peak.

Real equity growth since early 2020 has been modest. Inflation-adjusted prices rose about 17% in Australia and 11% in Canada, were flat in New Zealand, and fell roughly 4% in the UK. As expectations reset, sales activity has begun to recover.

"I've never seen such a wide gap between prices and incomes," said Eliza Owen, head of research at Cotality Australia. "Affordability is colliding with stalled interest rates. It may not derail the market, but it will cool growth and weigh on volumes."

Equity Cushions and Constraints

The U.S. remains the exception. American homeowners held about $17 trillion in equity in the third quarter of 2025, according to Cotality. That buffer allows households to wait--and slows the system as a whole.

The Federal Housing Finance Agency estimates that 1.7 million home sales didn't occur between 2022 and 2024 because owners chose not to give up historically low rates. With the national median home price near $400,000, barriers to entry continue to rise.

Staying put carries costs. Property taxes have climbed by about $700 annually since 2020, while insurance adds roughly $1,000 a year in several high-risk states. For some households, those pressures become catalysts to move.

A Slow Path to Reset

Policymakers are weighing tools to restore mobility, including longer loan terms and portable mortgages that would allow homeowners to move without surrendering existing rates. The tradeoffs are steep. A 50-year mortgage on a $320,000 loan at 6% would cut monthly payments by about $225--but add roughly $335,000 in interest over the life of the loan.

Cotality expects constrained mobility to persist through at least 2027, driven by strong equity positions and the gradual accumulation of life-driven demand. Listings will be the first signal of a thaw.

As more households reach moments where staying no longer works, the market will loosen. The pace of that release will shape decisions across lending, insurance, construction, and local governments--and determine how long America's housing pause lasts.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026