Residential Real Estate News

U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

Residential News » Austin Edition | By Michael Gerrity | January 21, 2026 6:15 AM ET

The National Housing Market Tilts Sharply Toward Buyers in Late 2025

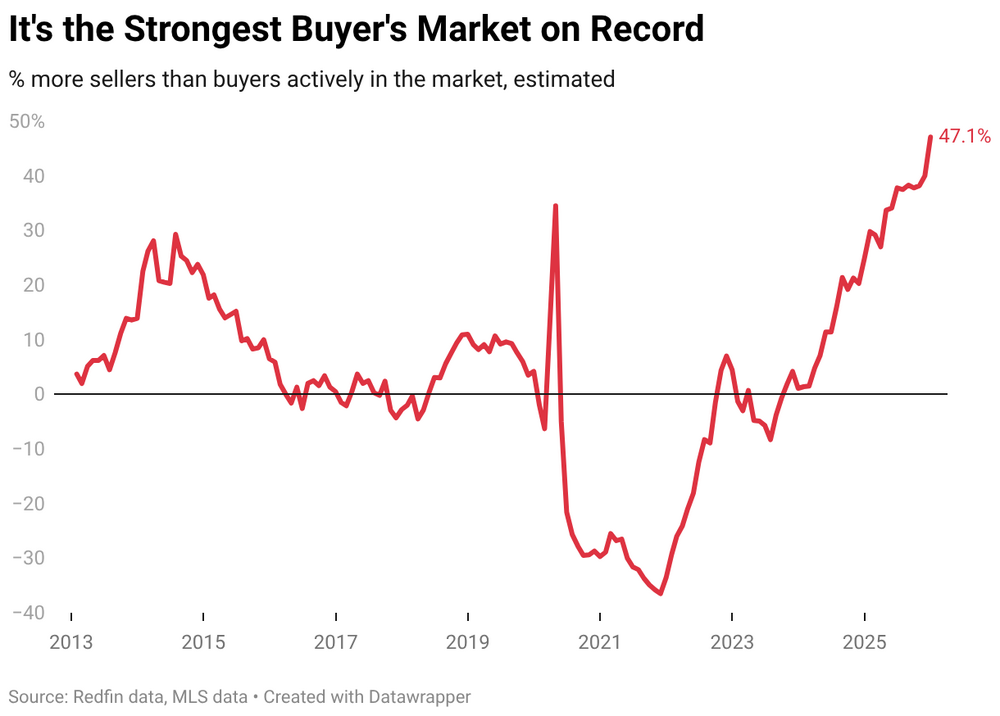

The U.S. housing market swung decisively into buyer-friendly territory at the end of last year, as a widening mismatch between supply and demand reached levels unseen in more than a decade.

In December 2025, there were an estimated 47.1% more home sellers than buyers nationwide--roughly 631,500 additional sellers--marking the largest imbalance since records began in 2013. The gap widened rapidly, increasing 7.1 percentage points from November, the biggest one-month jump since September 2022, and surged 22.2 percentage points from a year earlier.

By standard industry definitions, the market has been firmly tilted in buyers' favor since May 2024. A buyer's market is defined as one in which sellers outnumber buyers by more than 10%, while a seller's market exists when buyers exceed sellers by the same margin. A narrower spread is considered balanced.

When supply overwhelms demand, negotiating leverage typically shifts to buyers, who can shop more selectively and demand concessions. That dynamic is now playing out across much of the country, though affordability constraints mean the advantage applies primarily to households able to qualify for today's high prices and mortgage rates.

High housing costs, elevated borrowing expenses, and broader economic uncertainty have pushed many would-be buyers to the sidelines, leaving sellers competing for a shrinking pool of demand.

"Some home sellers are underwater because Dallas does not have enough housing demand to absorb the supply, which hit a record high this year," said Connie Durnal, a Redfin Premier real estate agent in Dallas. "I have one seller who overpaid at the peak of the pandemic market and is now taking a 10% loss. He understands the market has shifted, but many sellers are still in denial. If a home isn't priced realistically, it will sit."

Dallas illustrates the pressures facing Sun Belt markets that expanded rapidly during the pandemic boom. In December, the metro area had an estimated 86.8% more sellers than buyers--among the widest gaps across the 50 largest U.S. metropolitan areas. Years of aggressive homebuilding have left inventories elevated just as demand has cooled.

The imbalance is weighing on prices. The median home sale price in Dallas fell 7.6% from a year earlier in December, the steepest decline among the top 50 metros. Nationally, prices edged up just 0.1%, the slowest pace of growth since June 2023.

Buyers Retreat Faster Than Sellers

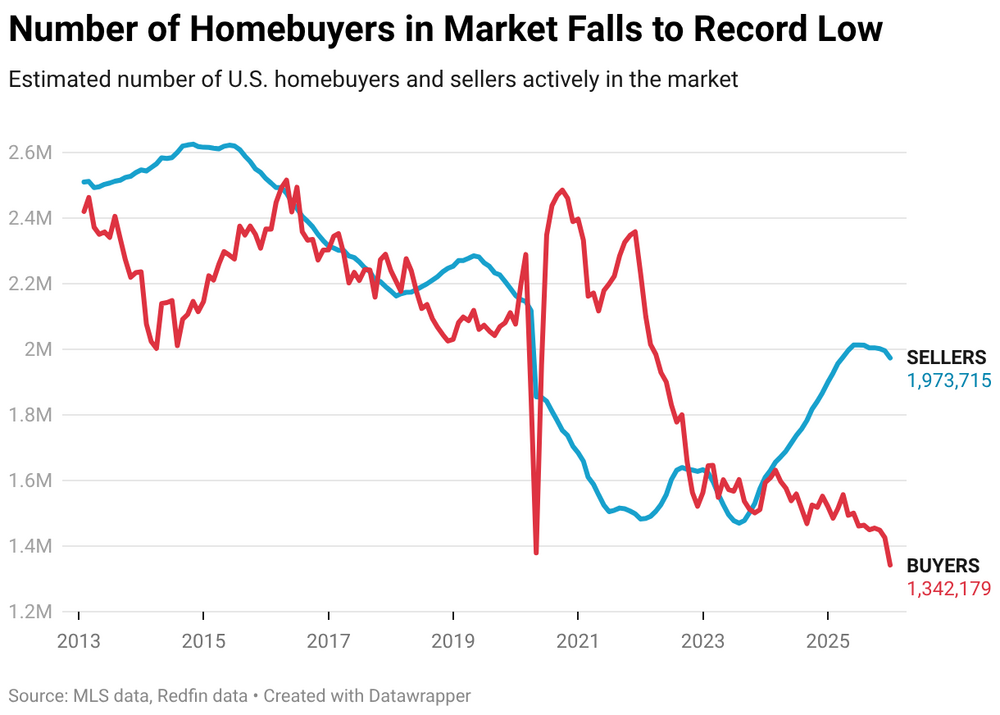

The shift toward a buyer's market has been driven primarily by a sharp pullback in demand. The number of active homebuyers fell 5.9% in December from the prior month to an estimated 1.34 million--the largest monthly drop since March 2023 and the lowest level in data going back to 2013.

Sellers have also stepped back, though far less dramatically. The number of homes listed for sale declined 1.1% month over month to about 1.97 million, the steepest drop since June 2023 and the lowest level since February 2025.

On an annual basis, the divergence is even more pronounced: buyer counts fell 11.8% from a year earlier, while the number of sellers rose 3.9%.

Buyers are being deterred by persistently high prices and mortgage rates, job-market uncertainty, layoffs in key sectors, and mounting political and economic volatility. Sellers--many of whom are also prospective buyers--are increasingly responding to sluggish demand by pulling listings after months without offers or opting not to list at all after seeing nearby homes sell below asking prices.

Sun Belt Markets Lead the Buyer's Shift

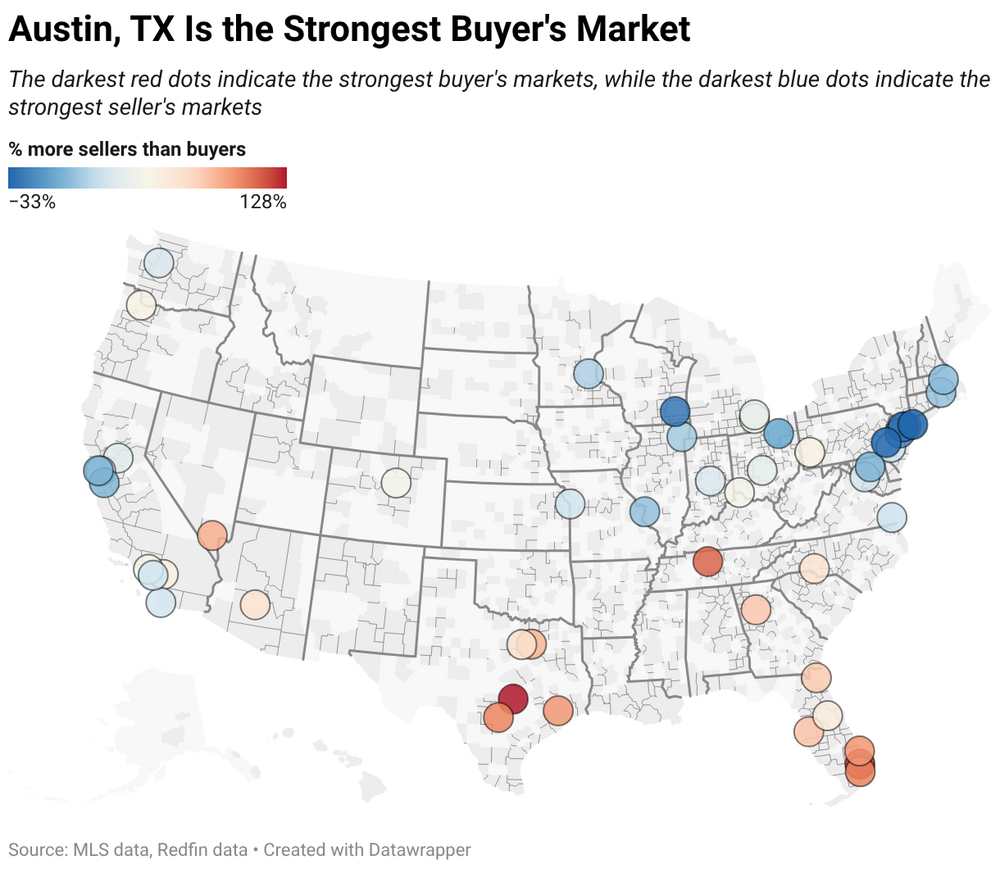

The strongest buyer's markets are concentrated in the Sun Belt, where pandemic-era migration fueled an unprecedented construction boom.

Austin, Texas, posted the most extreme imbalance in December, with 128% more sellers than buyers. It was followed by Fort Lauderdale, Florida (125%), Nashville (111%), Miami (103%), and San Antonio (103%).

During the pandemic, buyers from higher-cost coastal markets poured into these metros, prompting builders to rapidly expand supply. Now, the pipeline of new homes is colliding with diminished affordability and slower population inflows.

Texas and Florida continue to outpace other states in new home construction. Florida, in particular, is also contending with rising insurance premiums, escalating condo association fees, and growing exposure to climate-related risks--factors that have prompted some homeowners to exit the market altogether.

Across the country, 36 of the 50 most populous U.S. metros were classified as buyer's markets in December. Nine were considered balanced, and only five remained seller's markets. Buyer-friendly conditions were most prevalent in the South and West, while tighter markets were concentrated in the Midwest and Northeast, where construction has historically lagged population growth.

Nassau County, New York, emerged as the strongest seller's market, with 33.4% fewer sellers than buyers. Other seller-leaning markets included Montgomery County, Pennsylvania; Newark and New Brunswick, New Jersey; and Milwaukee.

The disparity underscores the influence of new construction on pricing power. Regions that have issued fewer building permits over the past decade--particularly in the Northeast and Midwest--continue to experience tighter supply, while markets that built aggressively are now absorbing the consequences.

Price trends reflect the divide. Home prices rose an average of 4.9% year over year across the five seller's markets in December, compared with gains of 3% in balanced markets and just 0.6% in buyer's markets--further evidence that excess supply is giving buyers greater leverage where inventory is abundant.

For sellers in many parts of the country, the message is increasingly clear: price realism, not optimism, now determines whether a home will move.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026