Residential Real Estate News

Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

Residential News » Dubai Edition | By Michael Gerrity | February 6, 2026 5:08 AM ET

Dubai and Hong Kong lead the world in high-end home sales in Q4

Ultra-prime residential property markets closed the year with a surge in blockbuster transactions, even as annual momentum cooled modestly from mid-year highs, underscoring a bifurcated global luxury housing landscape shaped by tax policy, cross-border capital flows and shifting investor sentiment.

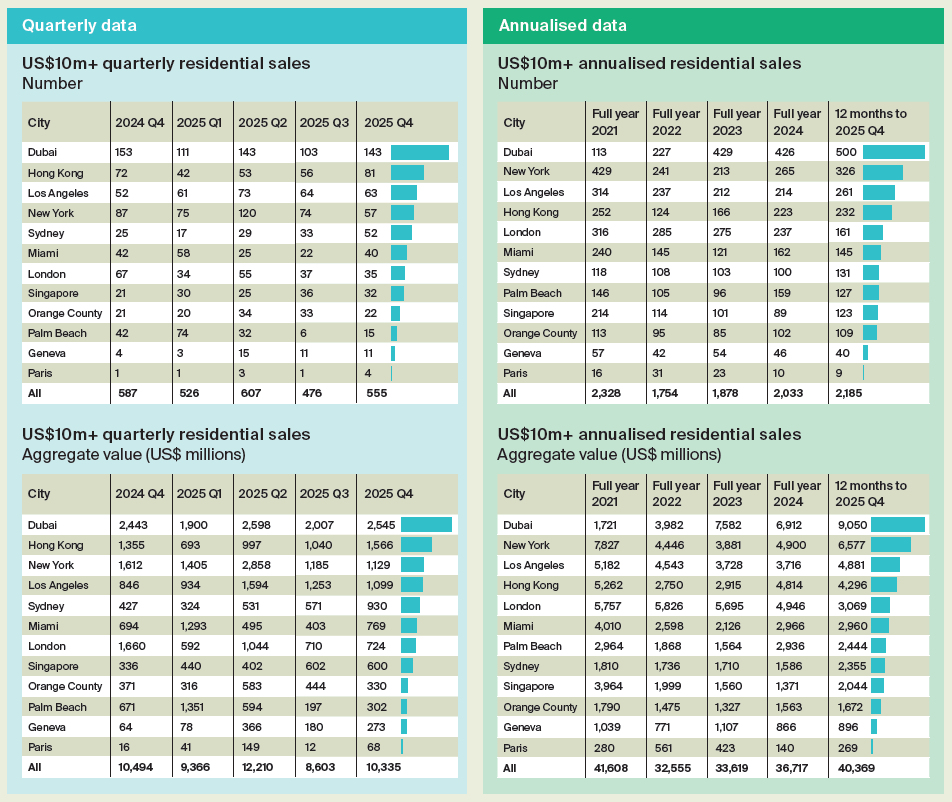

Data compiled by international brokerage Knight Frank show that 555 homes priced above $10 million changed hands across a dozen major cities in the fourth quarter of 2025, representing roughly $10.3 billion in aggregate value. "What we are seeing is not a retreat of wealth, but a redistribution of it," said Liam Bailey, global head of research at Knight Frank, noting that buyers are increasingly prioritizing jurisdictions offering fiscal clarity and lifestyle security. The typical deal size edged higher to about $18.6 million, reflecting a tilt toward larger trophy acquisitions. Activity accelerated notably from the prior quarter in Dubai, Hong Kong, Sydney and Miami, offsetting softer conditions in several established U.S. gateway markets.

Viewed over a rolling 12-month period, total ultra-luxury sales reached 2,164 transactions worth approximately $40.5 billion. While slightly below the preceding quarter's peak, the tally marked the second-strongest annual performance since 2021, highlighting the durability of demand among the world's wealthiest buyers despite elevated financing costs and geopolitical uncertainty. Bailey added that "liquidity at the very top of the market remains surprisingly deep, but it is increasingly selective and policy-sensitive."

Dubai Extends Lead

Dubai once again emerged as the dominant hub for ultra-prime trading at year-end 2025, leading all tracked cities in both the number and dollar value of deals. The emirate logged 143 transactions above $10 million in the quarter, totaling roughly $2.5 billion, as inflows of global wealth and a steady pipeline of newly delivered luxury developments sustained momentum. Transaction volumes and values both rose sharply from the previous quarter, reinforcing the city's position as the most active marketplace for top-tier residential assets.

Hong Kong advanced into second place, posting 81 qualifying sales worth about $1.57 billion. The rebound extended a recovery that began earlier in the year, aided by improved buyer confidence and selective price adjustments in the city's high-end segment.

New York and Los Angeles followed, each recording just over 50 ultra-prime transactions. Both U.S. metros registered weaker quarter-on-quarter performance, reflecting thinner inventories of marquee single-family properties in Southern California and a subdued holiday-period slowdown in Manhattan.

Mixed Results Across the Middle Tier

Elsewhere, performance diverged widely. Sydney delivered one of the strongest quarterly turnarounds, with deal counts jumping by more than half as Australia's affluent housing sector proved resilient at the upper end of the price spectrum. Singapore eased slightly after a robust mid-year stretch, while London slipped further down the rankings by transaction count despite holding dollar volumes broadly steady at roughly $724 million.

The U.K. capital's softer showing has been closely tied to ongoing debate surrounding potential wealth and property-tax reforms, which agents say has tempered trading appetite among international buyers. "Fiscal signaling now moves prime markets almost as quickly as interest rates once did," Bailey observed, emphasizing that policy direction has become a leading indicator for cross-border demand. In the United States, Miami staged a pronounced rebound in late-year activity, whereas Orange County cooled after a busy summer. Palm Beach also posted gains, albeit from a comparatively low base of transactions.

Long-Term Shifts in Market Leadership

On an annual basis, structural changes in market hierarchy became more apparent. Dubai notched a record year with approximately 500 ultra-prime sales, more than triple London's total and cementing its multi-year ascent as the world's most active luxury residential arena. New York recovered significantly from its 2023 trough, while Hong Kong continued a gradual climb up the league tables.

London, by contrast, fell to fifth place in annual rankings after having led as recently as 2022, illustrating the sensitivity of high-value property markets to fiscal policy signals. Among U.S. coastal and Sun Belt markets, Los Angeles and Orange County recorded year-on-year increases in top-end sales, while Miami and Palm Beach saw modest pullbacks compared with the prior year's elevated levels.

Market researchers say the trajectory of interest rates, evolving tax regimes and cross-border wealth migration will remain the primary determinants of ultra-luxury housing performance in early 2026. "The pool of global high-net-worth buyers is still expanding," Bailey said, "but where that capital ultimately lands is increasingly dictated by regulation, taxation and long-term stability rather than pure lifestyle appeal."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026