Residential Real Estate News

European Ski Chalet Prices Continue to Rise Despite Global Economic Uncertainty

Residential News » Chamonix Edition | By Michael Gerrity | November 9, 2023 9:32 AM ET

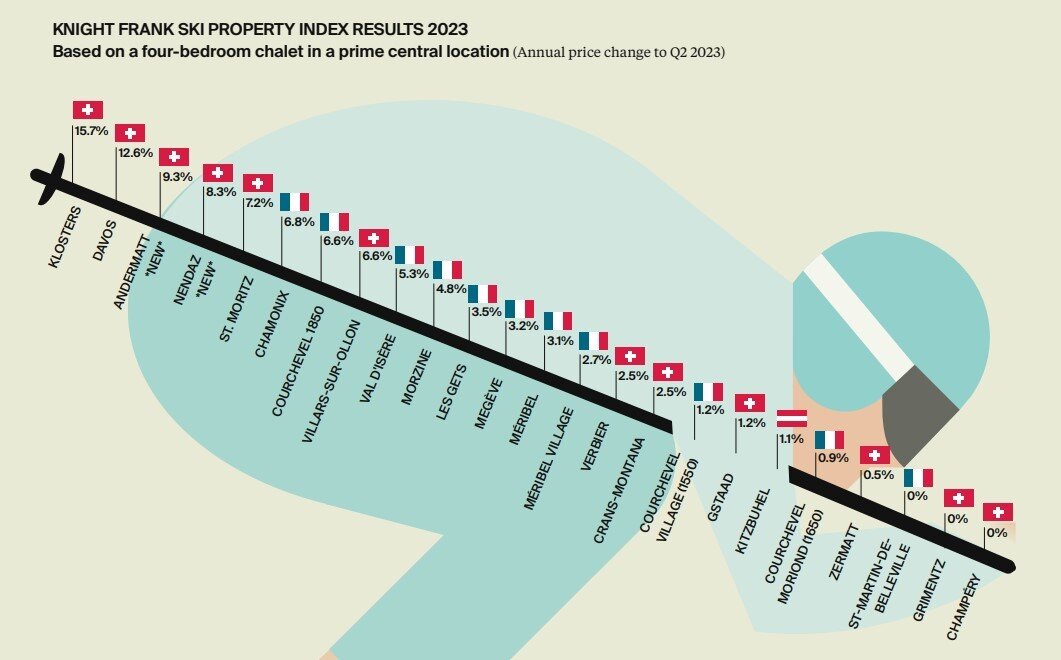

According to Knight Frank's newly released 2024 Ski Property Report, the price of a European ski chalet increased by 4.4% on average in the 12 months to June 2023. Except for the pandemic years, it represents the strongest rate of growth since 2014.

Knight Frank's Ski Property Index reveals that Swiss resorts lead the rankings for the second year running, with three German-speaking resorts - Klosters (16%), Davos (13%), and Andermatt (9%), occupying the top spots. A severe lack of stock and infrastructure improvements in each resort are pushing prices higher.

Chamonix (7%) retains its title as the top-performing resort in the French Alps, a true year-round resort whose population surges from 10,000 to 130,000 during peak season. The resort attracts a broad demographic, from skiers to mountain bikers, and plays host to a busy calendar of sporting events which also drives investor demand.

In 2023, two trends emerged in the Alps, high-altitude resorts (e.g. St. Moritz, Val d'Isère, Courchevel 1850) and year-round resorts (e.g. Chamonix and Verbier) outperformed. Buyers either prioritised snow-sure resorts with longer ski seasons or targeted locations offering a broader mix of ski and non-ski activities and a livelier resort during the summer months.

Kate Everett-Allen, head of global residential research at Knight Frank said, "The pandemic-induced Alpine mini boom is ending with a fizzle rather than a bang, as limited supply keeps a floor under prices in most markets. Across three key French resorts, listings are down 56% on average compared to before the pandemic and this is set against a backdrop of robust demand.

"There are clear challenges ahead for ski resorts, not least climate change, the need to upgrade infrastructure and strict planning rules. But the market is evolving, attracting buyers from further afield (Asia and the Middle East) and from southern Europe, as recent heat waves prompt some second homeowners to pivot northwards."

Alpine Homes Sentiment Survey

As part of the Ski Property Report, Knight Frank has run its second annual Alpine Homes Sentiment Survey, which represents the views of over 320 Knight Frank clients, located across 34 countries and territories. Respondents include existing homeowners, prospective purchasers, and those with a passion for the mountains.

Key findings include:

- Buyer motivations are diverging. Both the proportion of buyers wanting a base purely for skiing and those just wanting a base to enjoy the mountains has increased year-on-year.

- 72% of survey respondents say the resilience of a ski resort influences their decision on where to buy.

- 52% of respondents are seeking a second home that they plan to rent out, up from 48% last year.

- 78% of respondents say the energy efficiency of a home is important or very important to them, yet only 28% would be willing to pay a premium for such a home.

- 60% of survey respondents expect the price of an Alpine property to rise in the next 12 months.

- 39% of prospective buyers say the cost-of-living crisis has impacted the budget they will allocate to an Alpine home.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026