Residential Real Estate News

Residential Rents in U.S. Post First Annual Decline in 3 Years

Residential News » Austin Edition | By Michael Gerrity | April 17, 2023 8:35 AM ET

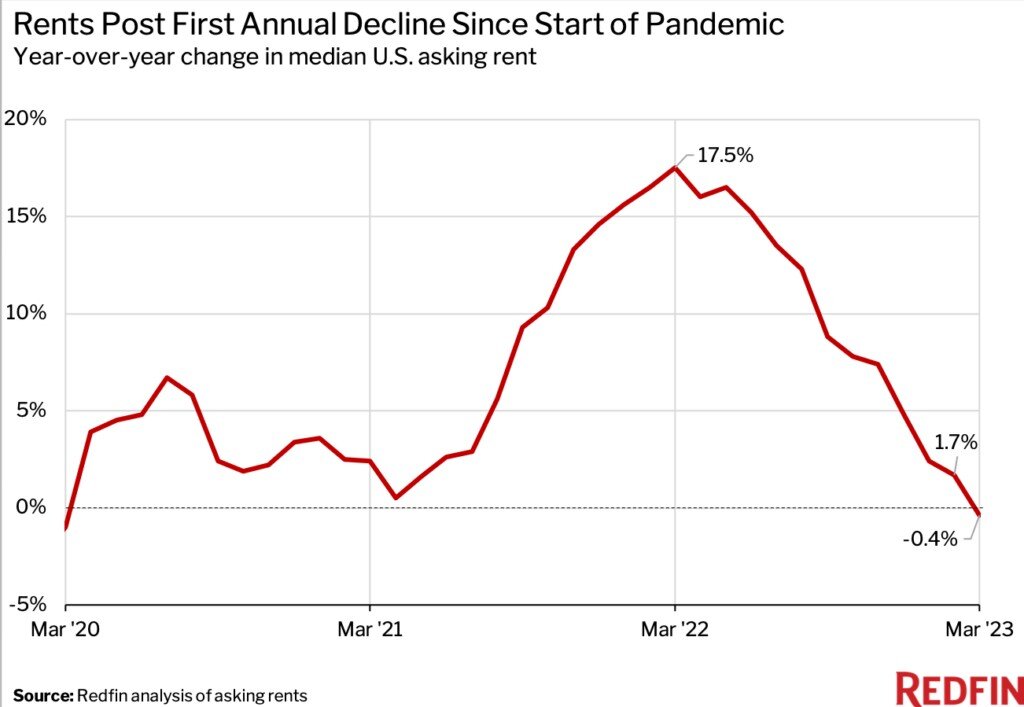

According to new research by Redfin, the median U.S. asking rent fell 0.4% year over year to $1,937 in March--the first annual decline since March 2020 and the lowest median asking rent in 13 months. By comparison, rents were up 17.5% one year earlier, in March 2022.

The median asking rent in March was unchanged from February. It remained $322 higher (19.9%) than it was at the onset of the pandemic three years earlier, though wages increased at roughly the same pace during this time.

"Rents are falling, but it feels more like they're just returning to normal, which is healthy to some degree," said Dan Close, a Redfin real estate agent in Chicago, where the median asking rent in March was 9.2% lower than it was a year earlier. "It's similar to the cost of eggs. You can say egg prices are plummeting, but what's really happening is they're finally making their way back to the $3 norm instead of $5 or $6. Rents ballooned during the pandemic, and are now returning to earth."

Rents surged during the past two years because incomes increased and household formation rose as more millennials started families. But household formation is now slowing, partly because many people are opting to stay put rather than move during a time of economic uncertainty.

Rents Drop Due to Supply Glut, Inflation, Economic Uncertainty

Rents declined from a year earlier in March largely due to a surplus of supply resulting from the pandemic homebuilding boom. The number of multifamily units that went under construction and the number completed each rose to the second highest level in more than three decades in February, the latest month for which data is available. Completed residential projects in buildings with five or more units jumped 72% year over year on a seasonally-adjusted basis to 509,000, the highest level since 1987 with the exception of February 2019. Started projects in buildings with five or more units rose 14.3% to 608,000, the highest level since 1986 with the exception of April 2022.

The short-term rental market is in a similar situation. The Airbnb market is oversaturated with supply and authorities are imposing tougher restrictions on hosts in some areas, driving some owners to lower rents or sell, according to Redfin agents.

The overall rental market is also cooling because still-high rental costs, inflation, rising unemployment and recession fears are causing rental demand to ease. Rental vacancies are on the rise, prompting some landlords to cut rents and/or offer concessions like discounted parking.

Rents Declined in 13 Major U.S. Metro Areas

1. Austin, TX (-11%)

2. Chicago, IL (-9.2%)

3. New Orleans, LA (-3%)

4. Birmingham, AL (-2.9%)

5. Cincinnati, OH (-2.9%)

6. Sacramento, CA (-2.8%)

7. Las Vegas, NV (-2.4%)

8. Atlanta, GA (-2.3%)

9. Phoenix, AZ (-2.1%)

10. Baltimore, MD (-2%)

11. Minneapolis, MN (-1.6%)

12. Houston, TX (-1.5%)

13. San Antonio, TX (-1.3%)

"A lot of people in Chicago became landlords during the pandemic," Close said. "Some were looking to cash in on soaring rents. Some rented out their homes because selling would've meant giving up their rock-bottom mortgage rate. Others tried to sell but didn't get a satisfactory offer due to slowing homebuyer demand. Now we have a lot of rental supply, which is bringing prices down because renters have more options."

Raleigh, Cleveland Saw Largest Rent Increases

1. Raleigh, NC (16.6%)

2. Cleveland, OH (15.3%)

3. Charlotte, NC (13%)

4. Indianapolis, IN (10.5%)

5. Nashville, TN (9.6%)

6. Columbus, OH (9.4%)

7. Kansas City, MO (8.1%)

8. Riverside, CA (7.2%)

9. Denver, CO (7%)

10. St. Louis, MO (4.2%)

Three factors have driven up rents in Nashville, according to local Redfin real estate agent Jennifer Bowers: investors, high home prices and a strong local job market.

"Tons of investors bought homes in Nashville and turned them into rentals during the pandemic in order to take advantage of low mortgage rates and rising rental demand--which allowed them to jack up rents. While investors have since pumped the brakes on purchases, they haven't cut rents," Bowers said. "Demand for rentals rose in part because skyrocketing housing prices pushed homeownership out of reach for many families. Elevated mortgage rates over the last year-and-a-half have also priced buyers out."

The average 30-year-fixed mortgage rate is now 6.27%, down from a fall peak of 7.08%, but up from 5% in April 2022, which has sent the typical homebuyer's monthly payment up by nearly $300 from a year ago. While home prices have started falling on a year-over-year basis, they remain more than 30% higher than they were when the pandemic started.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026