Residential Real Estate News

Homeownership Less Affordable in Late 2021 as Prices Keep Soaring in U.S.

Residential News » Irvine Edition | By WPJ Staff | January 4, 2022 8:47 AM ET

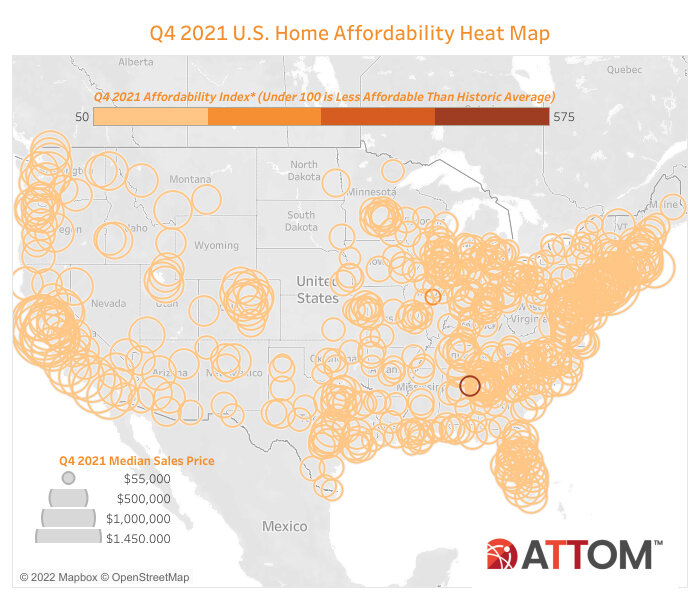

According to ATTOM's fourth-quarter 2021 U.S. Home Affordability Report, median-priced single-family homes in the U.S. are less affordable in the fourth quarter compared to historical averages in 77 percent of counties across the nation with enough data to analyze. That's up from just 39 percent of counties that were historically less affordable in the fourth quarter of 2020, to the highest point in 13 years, as home prices continue rising faster than wages throughout much of the country.

The report determined affordability for average wage earners by calculating the amount of income needed to meet major monthly home ownership expenses -- including mortgage, property taxes and insurance -- on a median-priced single-family home, assuming a 20 percent down payment and a 28 percent maximum "front-end" debt-to-income ratio. That required income was then compared to annualized average weekly wage data from the Bureau of Labor Statistics.

Compared to historical levels, median home prices in 440 of the 575 counties analyzed in the fourth quarter of 2021 are less affordable than past averages. The latest number is up from 428 of the same group of counties in the third quarter of 2021 and 224 in the fourth quarter of 2020 - an increase that has continued as the median national home price has shot up 17 percent over the past year to a record high of $317,500.

While major ownership costs on median-priced homes do remain within the financial means of average workers across the nation in the fourth quarter of 2021, the percentage of counties where affordability is worse than historical averages has hit another high point since the third quarter of 2008.

The latest pattern - home prices still manageable but getting less affordable - has resulted in major ownership costs on the typical home consuming 25.2 percent of the average national wage of $65,546 in the fourth quarter of this year. That is up from 24.4 percent in the third quarter of 2021 and 21.5 percent in the fourth quarter of last year. Still, the latest level is within the 28 percent standard lenders prefer for how much homeowners should spend on mortgage payments, home insurance and property taxes.

The mixed fourth-quarter patterns follow similar trends over the past year as the U.S. housing market continues booming for the 10th straight year both because of an in spite of the Coronavirus pandemic that hit in early 2020 and damaged major sectors of the U.S. economy.

House hunters largely unscathed financially by the pandemic have surged into the market amid a combination of mortgage rates hovering around 3 percent and a desire to trade congested virus-prone areas for the perceived safety of a house and yard, as well as the space for growing work-at-home lifestyles. But they have been chasing a tight supply of homes made tighter by the pandemic. The soaring demand combined with the limited supply have pushed prices ever higher and affordability downward.

"The average wage earner can still afford the typical home across the United States, but the financial comfort zone continues shrinking as home prices keep soaring and mortgage rates tick upward," said Todd Teta, chief product officer with ATTOM. "Historically low rates and rising wages are still big reasons why workers can meet or come very close to standard lending benchmarks in a majority of counties we analyze. But the portion of wages required for major ownership expenses nationwide is getting closer to levels where banks become less likely to offer home loans. Amid very uncertain times, with the pandemic again threatening the economy, we will keep watching this key measure of housing market stability."

Despite the continued decline in historic affordability, major home-ownership expenses on typical homes still are affordable to average local wage earners in about half of the 575 counties in the report, based on the 28-percent guideline. The largest are Cook County (Chicago), IL; Harris County (Houston), TX; Dallas County, TX; Bexar County (San Antonio), TX, and Wayne County (Detroit), MI.

The most populous of the 279 counties where major expenses on median-priced homes are unaffordable for average local workers in the fourth quarter of 2021 are Los Angeles County, CA; Maricopa County (Phoenix), AZ; San Diego County, CA; Orange County, CA (outside Los Angeles) and Miami-Dade County, FL.

Home prices up at least 10 percent in two-thirds of country

Median single-family home prices in the fourth quarter of 2021 are up by at least 10 percent over the fourth quarter of 2020 in 368, or 64 percent, of the 575 counties included in the report. Data was analyzed for counties with a population of at least 100,000 and at least 50 single-family home and condo sales in the fourth quarter of 2021.

Among the 43 counties with a population of at least 1 million, the biggest year-over-year gains in median prices during the fourth quarter of 2021 are in Middlesex County (outside Boston), MA (up 42 percent); Wake County (Raleigh), NC (up 27 percent); Maricopa County (Phoenix), AZ (up 26 percent); Hillsborough County (Tampa), FL (up 26 percent) and Clark County (Las Vegas), NV (up 23 percent).

Counties with a population of at least 1 million where median prices have decreased year-over-year in the fourth quarter of 2021, or gone up by the smallest amounts, are Wayne County (Detroit), MI (down 12 percent); Cook County (Chicago), IL (down 3 percent); Kings County (Brooklyn), NY (up 2 percent); Dallas County, TX (up 5 percent) and Contra Costa County, CA (outside San Francisco) (up 6 percent.)

Price gains outpace wage growth in nearly 80 percent of markets

Home-price appreciation is greater than weekly wage growth in the fourth quarter of 2021 in 447 of the 575 counties analyzed in the report (78 percent), with the largest including Harris County (Houston), TX; Maricopa County (Phoenix), AZ; San Diego County, CA; Orange County, CA (outside Los Angeles) and Miami-Dade County, FL.

Average annualized wage growth is outpacing home-price appreciation in the fourth quarter of 2021 in 128 of the counties included in the report (22 percent), including Los Angeles County, CA; Cook County, (Chicago), IL; Dallas County, TX; Kings County (Brooklyn), NY, and King County (Seattle), WA.

Ownership costs still require less than 28 percent of average local wages in half the nation

Major ownership costs on median-priced homes in the fourth quarter of 2021 consume less than 28 percent of average local wages in 296 of the 575 counties analyzed in this report (51 percent), assuming a 20 percent down payment. That was about the same as in the third quarter of 2021 for the same group of counties, but down from about two-thirds in the fourth quarter of last year.

Counties where the smallest portion of average local wages is required to afford the typical home are Schuylkill County, PA (outside Allentown) (6.5 percent of annualized weekly wages needed to buy a home); Macon County (Decatur), IL (9.2 percent); Bibb County (Macon), GA (9.5 percent); Wayne County (Detroit), MI (10.6 percent) and Peoria County, IL (11.3 percent).

Aside from Wayne County, the counties with a population of at least 1 million where major ownership expenses typically consume less than 28 percent of average local wages in the fourth quarter of 2021 include Philadelphia County, PA (15.4 percent); Cuyahoga County (Cleveland), OH (15.7 percent); Cook County (Chicago), IL (20.6 percent) and Franklin County (Columbus), OH (21.8 percent).

A total of 279 counties in the report (49 percent) require more than 28 percent of annualized local weekly wages to afford a typical home in the fourth quarter of 2021. Counties that require the greatest percentage of wages are Kings County (Brooklyn), NY (76.5 percent of annualized weekly wages needed to buy a home); Santa Cruz County, CA (73.7 percent); Marin County, CA (outside San Francisco) (71.4 percent); Maui County, HI (67.3 percent) and San Luis Obispo County, CA (64.7 percent).

Aside from Kings County, NY, the counties with a population of at least 1 million where home ownership consumes the highest percentage of average annualized local wages in the fourth quarter include Orange County, CA (outside Los Angeles) (60.1 percent); Queens County, NY (59.9 percent); Nassau County, NY (outside New York City) (56.5 percent) and Alameda County (Oakland), CA (53.4 percent).

Just one in five counties require annual wage of more than $75,000 to afford typical home

Annual wages of more than $75,000 are needed to afford major costs on the median-priced home purchased during the fourth quarter of 2021 in just 114, or 20 percent, of the 575 markets in the report.

The top 30 highest annual wages required to afford typical homes are all on the east or west coasts, led by New York County (Manhattan), NY ($274,679); San Mateo County (outside San Francisco), CA ($252,589); San Francisco County, CA ($251,054); Santa Clara County (San Jose), CA ($229,301) and Marin County (outside San Francisco), CA ($223,713).

The lowest annual wages required to afford a median-priced home in the fourth quarter of 2021 are in Schuylkill County, PA (outside Allentown) ($10,927); Bibb County (Macon), GA ($16,483); Cambria County, PA (outside Pittsburgh) ($17,784); Macon County (Decatur), IL ($19,317) and Blair County (Altoona), PA ($20,363).

Homeownership less affordable than historic averages in three-quarters of counties

Among the 575 counties analyzed in the report, 440 (77 percent) are less affordable in the fourth quarter of 2021 than their historic affordability averages. That is about the same as in the third quarter of 2020, when 74 percent of the same group of counties were historically less affordable, but far higher than the 39 percent level in the fourth quarter of last year.

Counties with a population of at least 1 million that are less affordable than their historic averages (indexes of less than 100 are considered less affordable compared to historic averages) include Tarrant County (Fort Worth), TX (index of 75); Maricopa County (Phoenix), AZ (76); Mecklenburg County (Charlotte), NC (77); Hillsborough County (Tampa), FL (78) and Clark County (Las Vegas), NV (79).

Counties with the worst affordability indexes in the fourth quarter of 2021 include Rankin County (Jackson), MS (index of 50); Canyon County, ID (outside Boise) (60); Rutherford County (Murfreesboro), TN (62); Gaston County, NC (outside Charlotte) (63) and Wayne County, OH (outside Akron) (63).

Among counties with a population of at least 1 million, those where the affordability indexes worsened most from the fourth quarter of 2020 to the fourth quarter of 2021 are Middlesex County, MA (outside Boston) (index down 29 percent); Wake County (Raleigh), NC (down 21 percent); Maricopa County (Phoenix), AZ (down 21 percent); Hillsborough County (Tampa), FL (down 21 percent) and Clark County (Las Vegas), NV (down 19 percent).

Only a quarter of markets are more affordable than historic averages

Among the 575 counties in the report, 135 (23 percent) are more affordable than their historic affordability averages in the fourth quarter of 2021, down slightly from 26 percent of the same group in the prior quarter and 61 percent in the fourth quarter of last year.

Counties with a population of at least 1 million that are more affordable than their historic averages (indexes of more than 100 are considered more affordable compared to historic averages) include New York County (Manhattan), NY (index of 129); Montgomery County, MD (outside Washington, D.C.) (119); Cook County (Chicago), IL (113); Santa Clara County (San Jose), CA (113) and Fairfax County, VA (outside Washington, D.C.) (109).

Counties with the best affordability indexes in the fourth quarter of 2021 include Macon County (Decatur), IL (index of 191); Schuylkill County, PA (outside Allentown) (160); San Francisco County, CA (144); Peoria County, IL (135) and Columbiana County, OH (west of Pittsburgh, PA) (135).

Counties with a population of least 1 million residents where the affordability index improved most or declined the least from the fourth quarter of last year to the same period this year are Wayne County (Detroit), MI (index up 11 percent); Cook County (Chicago), IL (up 3 percent); Santa Clara County (San Jose), CA (down 2 percent); Kings County (Brooklyn), NY (down 4 percent) and Montgomery County, MD (outside Washington, DC) (down 4 percent).

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026