Residential Real Estate News

Luxury Markets Worldwide Enjoy Surge in $10 Million Plus Home Sales

Residential News » Laguna Beach Edition | By Michael Gerrity | July 30, 2021 8:48 AM ET

Based on new research by international property broker Knight Frank, cities worldwide are springing back to life and are fuelling a global surge in super-prime ($10m+) luxury home sales.

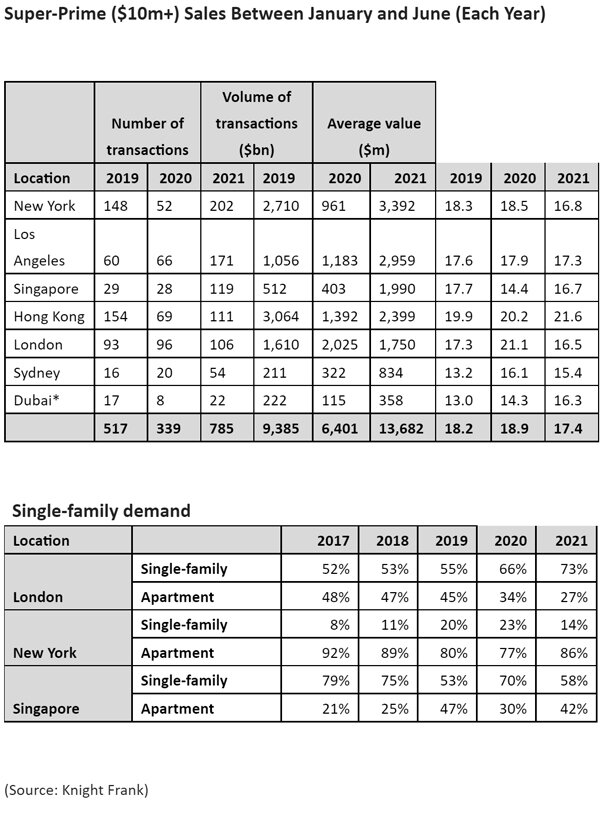

There were 785 super-prime sales that took place across seven global cities analyzed during the first six months of 2021, more than double the amount of sales compared to the same period in 2020 and up 52% on the corresponding period of 2019.

Liam Bailey, global head of research at Knight Frank said, "Vaccine roll outs have aided the reopening of some of the world's major cities - giving confidence to wealthy residents to commit to property moves in prime central locations. Despite concerns over new Covid variants - the search for space and a focus on well-being are driving decisions, and the prospect for easier cross-border travel in the final months of the year, means we expect super-prime sales to end 2021 on a high."

Wealthy buyers spent $13.8 billion, snapping up homes across New York, Los Angeles, Hong Kong, London, Sydney, Singapore and Dubai during the period.

New York was the most active super-prime market during the period, with 202 sales above $10m. The city is experiencing a rapid reopening and the state has now vaccinated 70% of its adult population. Interestingly, apartments are back in demand with super-prime sales of apartments rising from a low of 77% of all super-prime sales in 2020 to 86% in the first half of 2021.

Los Angeles has also seen a flurry of activity at the top end of the market with 171 sales so far in 2021 - almost three times the number over the same period in 2020. This follows the strength of the wider prime market in Los Angeles in the wake of the pandemic given its lifestyle offering. There are opportunities for large spacious homes, inside and outside, and weather that allows for year-round use of outside space.

Paddy Dring, global head of prime sales at Knight Frank said, "The positive sales data highlights the reassuring strength of domestic demand, coupled with ongoing and pent-up international demand in all key global cities.

"Each market has its own unique drivers of demand, whether that's recent price corrections, lifestyle advantages - such as beaches and green space, or the emergence of a new breed of super prime development. However, all markets share common themes - namely, rapidly improving sentiment amid the reopening of cities and a unified shift in lifestyles as the wealthy seek out larger homes and more amenity rich locations."

Sydney is seeing a similar rise in super-prime sales activity. In early 2021, sales more than doubled compared to the same period in 2020 from 20 to 54 and up 38 compared to the first six months of 2019. With Australia's international borders unlikely to open without restrictions before 2023, Sydney's ultra-wealthy are building their property portfolios at home. That includes upsizing family homes and purchasing homes for future generations, following a perceived notion that prices will continue to rise.

Singapore's super-prime segment has also been gaining momentum. There have been 119 sales above $10m in the first half of 2021, undoubtedly boosted by the 20 units sold at the prime new development 'Eden' averaging $11m each. This is more than four times the number compared to the same period last year and almost more than what was sold in the whole of 2020 and 2019 combined. Singapore has cemented itself as a safe haven for wealth, given how it handled the pandemic and economic fallout.

Hong Kong has seen $2.4 billion transacted so far this year, well above the $1.4 billion in the same period of 2020. The territory has seen a rebound in transaction volumes with prices now around 3% from their historical peak following a fall of 7% in 2020.

Paddy Dring, global head of prime sales at Knight Frank continues, "London's super-prime market was the most active in 2020 out of all the cities analyzed. The first six months of 2021 has seen sales 10% higher than the same period in 2020 with 106 and 96 sales respectively.

"Space and single-family homes have been highly sought after with their share of super-prime sales rising to 73% up from around 55% in 2019. Prices in prime central London also registered the first annual growth for five years in May of this year."

Dubai's super-prime market rebounded in 2021 with 22 sales in the first five months of 2021 (data is delayed by a month) , up from six in the same period of 2020.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026