Residential Real Estate News

March Construction Input Prices Up 24% Year Over Year in the U.S.

Residential News » Los Angeles Edition | By Michael Gerrity | April 20, 2022 8:37 AM ET

Runaway inflation, supply chain issues a major concern for the construction industry

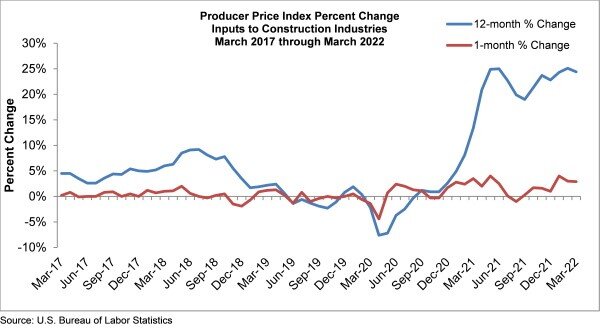

According to a new Associated Builders and Contractors analysis of the U.S. Bureau of Labor Statistics' Producer Price Index data, U.S. construction input prices rose 2.9% in March 2022. Nonresidential construction input prices expanded 2.8% for the month.

Construction input prices are up 24.4% from a year ago and 39.1% from February 2020, the month before the COVID-19 pandemic began to affect the economy, while nonresidential construction input prices are 25.0% and 39.2% higher, respectively. Natural gas prices are up more than 200% since the start of the pandemic, while crude petroleum prices are up more than 100% over that span.

"Consumers are right to complain about inflation, which has been north of 8% during the past year," said ABC Chief Economist Anirban Basu. "But America's contractors have experienced material price inflation nearly three times that during the same period. For now, there are few signs of relief. Many prices rose on a monthly basis in March, reflecting ongoing upward price momentum, including iron and steel (1.4%), key roofing materials (1.6%) and nonferrous wire and cable (4.4%).

"For contractors, this is not where the inflation narrative ends," said Basu. "Despite recent growth in the nation's labor force participation rate, contractors continue to contend with shortages of skilled construction workers. Supply chain setbacks related to the spread of another omicron variant along with the Russia-Ukraine war will also affect equipment availability. The latest ABC Construction Confidence Index survey indicates that approximately 3 in 4 contractors have suffered an interruption in delivering construction services in recent months. These challenges will persist.

"There is one more significant consideration for contractors," said Basu. "With inflation running hot, the Federal Reserve will have to work even harder to slow the economy to trim price pressures and expectations. Recession risks are accordingly rising, and while that is unlikely to affect the level of contractor activity in the near term, that could eventually set the stage for a period when demand for construction services declines."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026