Residential Real Estate News

Mortgage Credit Availability in U.S. Upticks in August

Residential News » Washington D.C. Edition | By WPJ Staff | September 10, 2021 8:55 AM ET

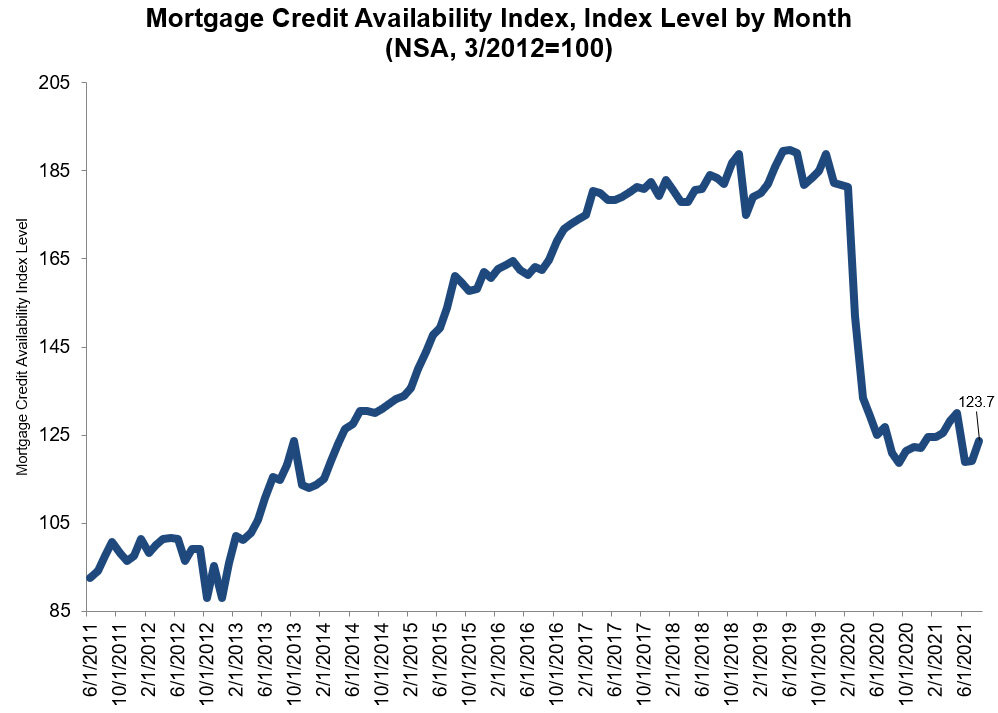

The Mortgage Bankers Association latest Mortgage Credit Availability Index (MCAI) revealed this week U.S. mortgage credit availability increased in August 2021.

The MCAI rose by 3.9 percent to 123.7 in August. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012. The Conventional MCAI increased 7.6 percent, while the Government MCAI increased by 1.1 percent. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 9.4 percent, and the Conforming MCAI rose by 5.1 percent.

"Credit availability increased in August, driven by significant activity across all indexes," said Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting. "This expansion was heavily driven by the addition of refinance loan programs at a time when the 30-year fixed rate has been above 3% for the past month, and refinance activity has trended lower. Of note, jumbo credit availability increased 9% to its highest level since March 2020, as more non-QM jumbo and agency-eligible high-balance loan programs were offered. In the conforming space, more lenders offered GSE refinance programs catered to lower-income borrowers to help reduce their rates and payments. There was also a slight expansion in government credit, as more investors offered streamline refinance options for FHA and VA loans."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Housing Market Tilts Toward Buyers as Prices Cool

- Ultra-Luxury Home Sales Surge Globally in Late 2025 as 555 Mega-Deals Close

- U.S. Luxury Home Prices Outpaced the Broader Market in 2025

- U.S. Homeowner Equity Growth Cooled in 2025 but Remained Historically Strong

- U.S. Homebuyers Scored Biggest Price Discounts Since 2012 as Market Shifts

- Ten Key Takeaways from the U.S. Housing Market in January

- Hong Kong Stock Market Front-Runs Local Home Prices by Two Months

- Mass Exodus: U.S. Homebuyers Cancel Deals at Record Levels

- U.S. Housing Outlook for 2026 Darkens After Sharp December Pullback in Contract Signings

- America's Housing 'Silver Tsunami' Is Turning Into a Trickle

- Builders Tell Congress Government Rules Are Pricing Americans Out of Housing

- California Housing Market Poised for Balanced Growth in 2026

- U.S. Housing Market Hits Largest Buyer-Seller Imbalance on Record

- Miami Housing Market Ends 2025 on Firmer Ground

- U.S. Homebuilder Confidence Dips at Start of 2026

- Remodeling Outlook Improves as U.S. Homeowners Tap Equity

- U.S. Home Sales Hit Three-Year High in December as Rates Ease

- Las Vegas Area Home Sales Hit 18-Year Low in 2025

- U.S. Mortgage Rates Hit Three-Year Low in January

- U.S. Home Affordability Closed Out 2025 Near Record Lows

- Ireland Home Prices Uptick 5.5 Percent in 2025 Amid Supply Shortages

- One Year After Los Angeles Wildfires, Investors Snap Up Burned Lots

- Greater Palm Beach Area Home Sales Surge in Late 2025

- U.S. Homebuilder Sentiment Ends 2025 in Negative Territory

- America's Single-Family Rent Boom Loses Steam in Late 2025

- Miami Home Price Gains Extend 14-Year Run in 2025

- Why Pre-Biden Mortgages Froze the U.S. Housing Market

- From Bricks to Blockchain: How Digital Dollars Could Soon Rewire Global Real Estate

- U.S. Home Sales Slightly Uptick in November

- Greater Orlando Area Home Sales Dive 22 Percent in November

- World Property Exchange Aims to Make Real Estate Ownership Instantly Tradeable and Democratized on a Planetary Scale

- Falling Home Prices Slash U.S. Homeowner Equity by $13,400 on Average in 2025

- Home Listings in U.S. See Sharpest Drop in Two Years Amid Cooling Buyer Demand

- Dutch Investors Pour Record $4.2 Billion in New Rental Housing in 2025

- U.S. Housing Markets Poised for 2026 Rebound, NAR Says

- Las Vegas Home Prices Hit Record High in November as Inventory Swells, Sales Cool

- Investors Accounted for 30 Percent of All U.S. Home Purchases in 2025

- Canadian Home Sales Recovery Continues in October

- Global Luxury Home Price Growth Cools to 2-Year Low in September

- U.S. Housing Market Recovery to Remain Fragile in 2026